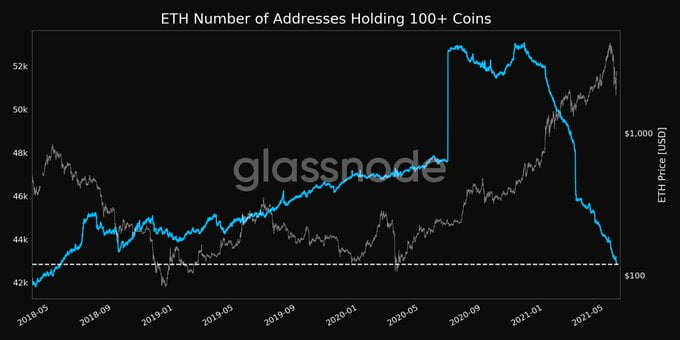

- The number of Ethereum addresses holding 100+ ETH drops to a 3 year low

- Such a drop is indicative of some ETH investors taking profits

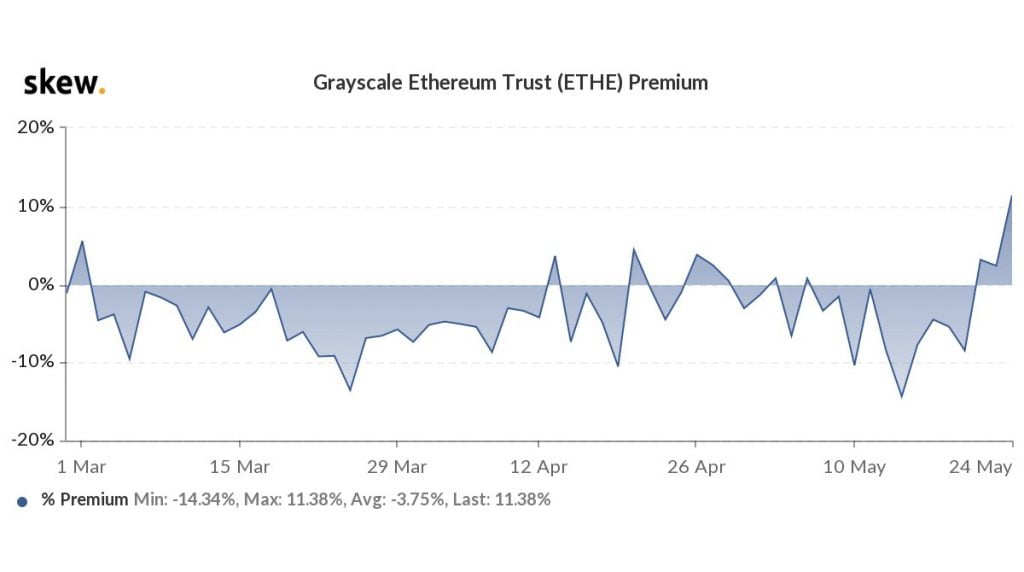

- However, the premium on Grayscale’s Ethereum Trust has turned positive hinting of institutional interest

- Ethereum is back above $2k and could eventually return to levels above $3k

The number of Ethereum addresses holding 100 or more ETH has dropped to a three-year low of 42,837. This is according to data shared by the team at Glassnode who also provided the following chart to demonstrate the drop in Ethereum holders with 100+ ETH.

Premium on Grayscale’s Ethereum Trust Flips to Positive

The drop in the number of Ethereum holders with 100 or more ETH hints at selling by this category of investors and is in tandem with ETH’s recent drop to $1,700 levels this past Sunday.

However, the sold Ethereum is probably being scooped up by institutional investors who see the long-term value of ETH. This demand is best exemplified by a remarkable increment in the premium on the Grayscale Ethereum Trust which is now at 11%. The premium on ETHE had spent the better part of the last three months in negative territory as seen in the following chart courtesy of Skew.

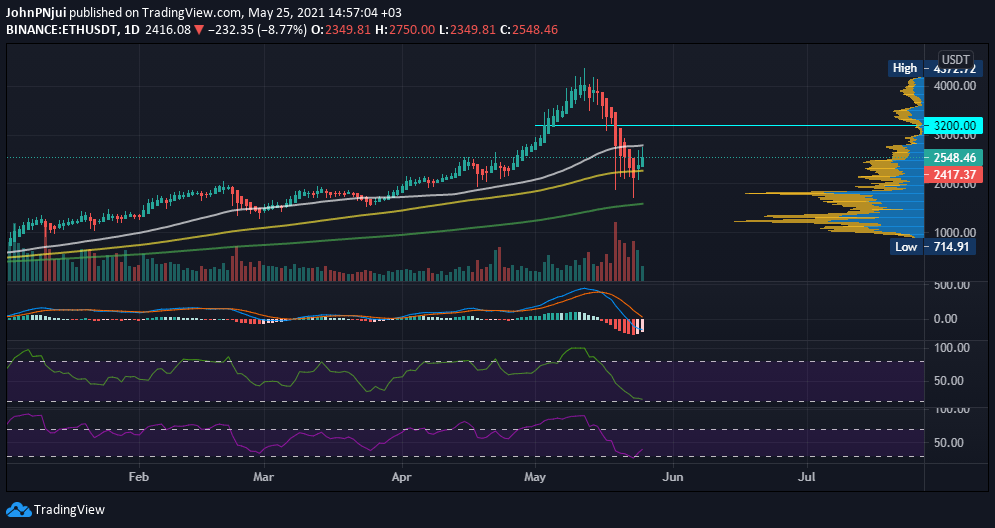

Ethereum Regains $2k and Could Recapture $3k by Early June

Ethereum Regains $2k and Could Recapture $3k by Early June

As earlier mentioned, Ethereum dropped to a local low of $1,728 this past Sunday. The number two digital asset in terms of market cap has since rebounded to a local peak of $2,750, which is a remarkable bounce of $1k or 58.8% in a 48 hour time period.

At the time of writing, Ethereum is defending the $2,400 price area as support with the 50-day moving average (white) acting as resistance at the $2,800 price area as seen in the daily ETH/USDT chart below.

Also from the chart, it can be observed that the three daily indicators – MACD, MFI and RSI – are pointing towards an attempt at a reversal as the month of June inches closer. Such a reversal will most likely include Ethereum cautiously retesting $3,200 where there might be additional selling pressure based on the general crypto market mood of fear due to the news of China banning BTC mining and crypto trading.