- ETH might be a better cryptocurrency of the future than Bitcoin.

- The chances of a strong ETH rally are still low.

Now that the crypto market has wrapped up a bearish 2022, crypto investors are likely re-evaluating their portfolios in preparation for the next 12 months. All sorts of opinions have been presented but one CryptoQuant analyst caught our attention with his ETH analysis.

Read Ethereum’s [ETH] price prediction 2023-2024

The analyst who goes by the pseudonym Ghoddusifar suggests that ETH might be a better cryptocurrency of the future than Bitcoin. The analysis was based on the fact that Ethereum has more use cases that span multiple segments including NFTs, dApps, and DeFi. According to Ghoddusifar’s assessment, the demand from these multiple segments has the potential to make ETH more useful.

Red versus blue

But can ETH really knock out BTC as the top crypto in 2023? It is true that Ethereum really packs a strong punch in terms of utility. However, BTC has demonstrated on multiple instances that it is the heavyweight champion of the crypto world. It has so far maintained its lead as far as market cap is concerned and still has the first-mover advantage.

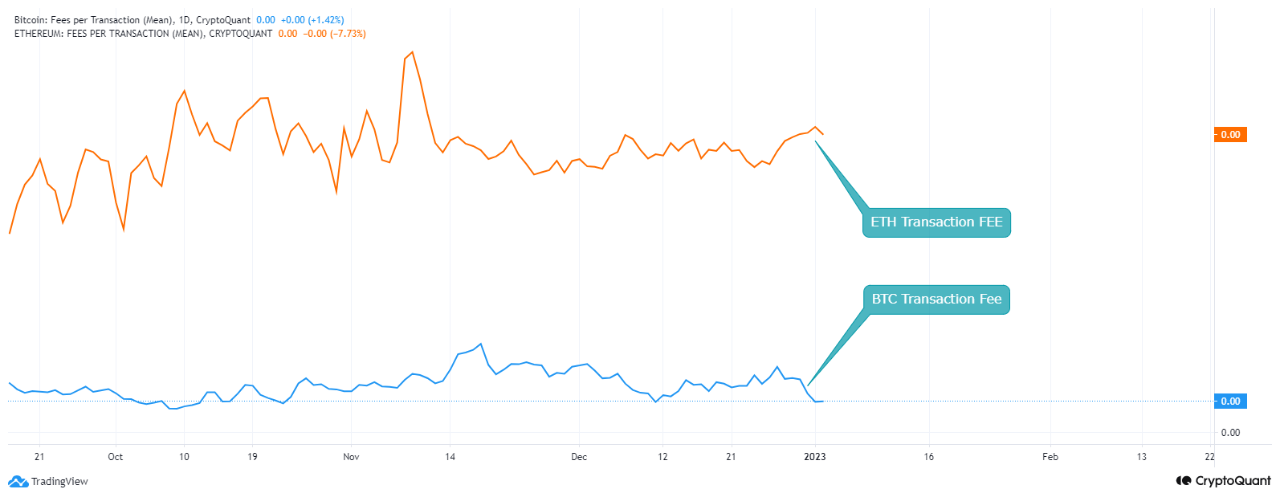

The analyst did highlight some of ETH’s downsides, such as the fact that it has higher transaction fees than Bitcoin. This puts it at a disadvantage to Bitcoin from a mass adoption point of view. Nevertheless, Ethereum did go through major changes that might transition it into the fast lane in 2023.

Will 2023 favor ETH?

ETH’s open interest has been growing for more than two weeks now, suggesting that demand in the derivatives market is recovering. At the same time, long liquidations have tanked. This might be a sign that the market is favoring the bulls.

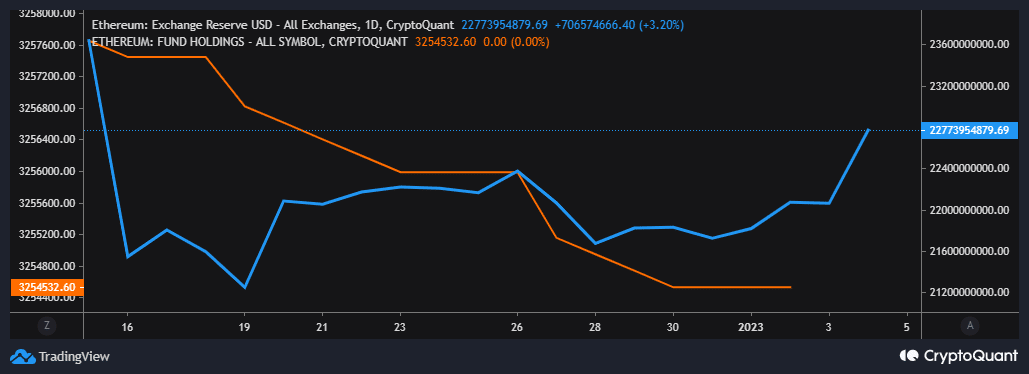

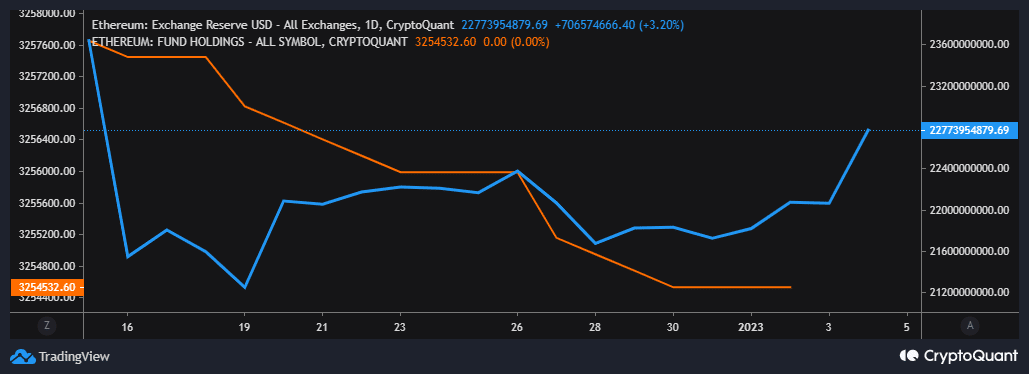

But it is not all good news for ETH because exchange reserves are up in the last two weeks. A surge in exchange reserve often means investors are moving their ETH from private wallets to exchanges. Usually with the intent of selling.

In addition, fund holdings registered outflows in December, suggesting that institutional investors were trimming their ETH balances.

The lack of institutional buying pressure means any upside in the next few days might be limited. Note that this does not necessarily have to be the case if the bullish start this week marks the start of the next bear market. That is a big “if” but if it happens, then we might see a resurgence of institutional demand.

A 0.15x hike on the cards if ETH hits Bitcoin’s market cap?

Conclusion

ETH might be showing bullish signs but a major upside is still at bay. Meanwhile, it may be going for the top spot but it will have to contend with other rivals offering the same if not better solutions.

And finally, Bitcoin and ETH have different strengths and weaknesses. ETH is not that far off from Bitcoin in terms of market cap. There is a real possibility of ETH surpassing BTC further down the road.