- Ethereum’s profits rise as trading activity increases due to USDC and SVB saga

- Short sellers face the heat as their positions get liquidated

The aftermath of the collapse of SVB and Signature bank has been felt by the stablecoin market and various holders alike. However, Ethereum [ETH] managed to benefit from the chaos that ensued following these events.

Read Ethereum’s Price Prediction 2023-2024

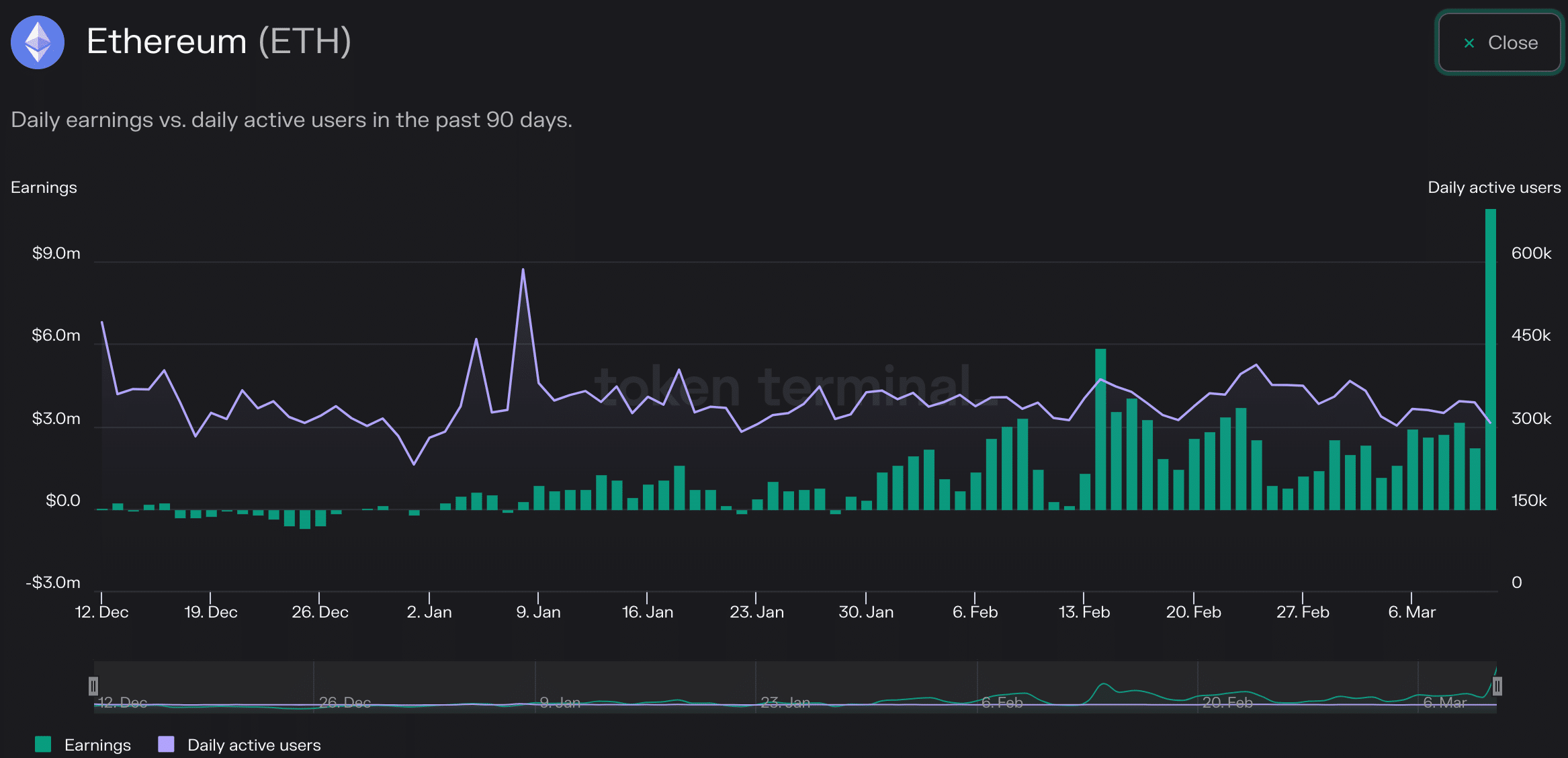

According to data provided by Token Terminal, Ethereum managed to earn a profit of $10 million over the last few days. Ethereum managed to achieve this feat despite the decline in daily active users on the network. This, due to the fact that the volume of trading activities and swaps appreciated during this period.

Source: token terminal

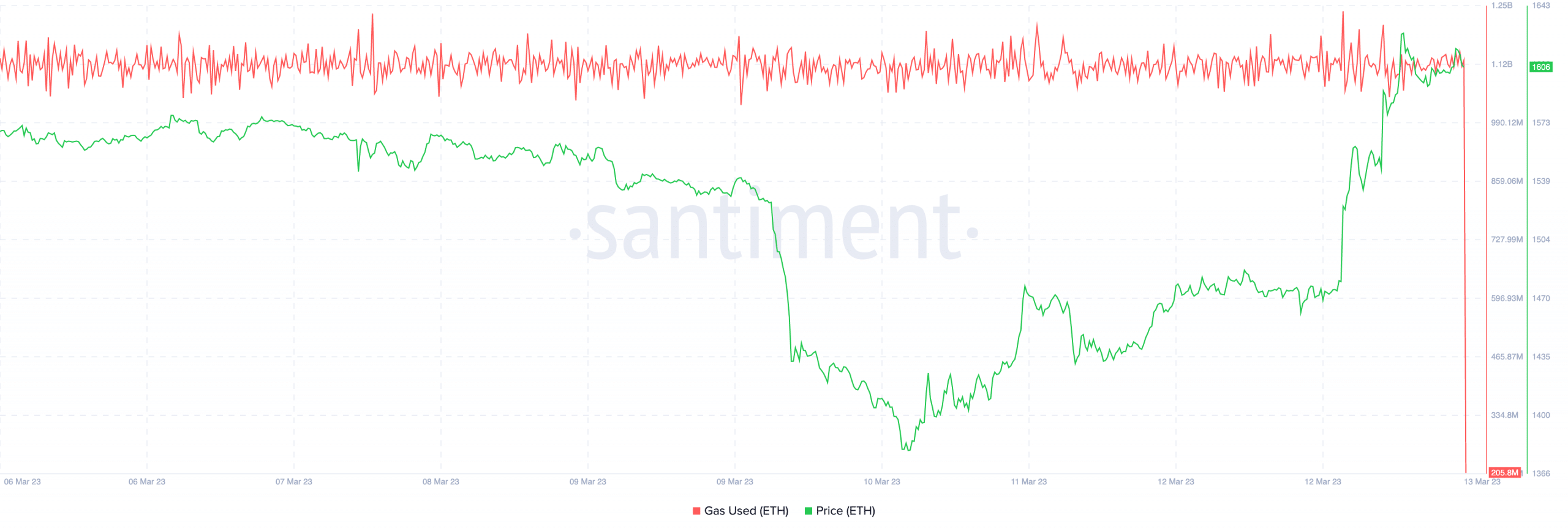

Thanks to the high activity on the Ethereum network, the overall gas being used on the network rose as well. The uptick in activity on the network was also accompanied by a surge in ETH’s prices.

A short squeeze

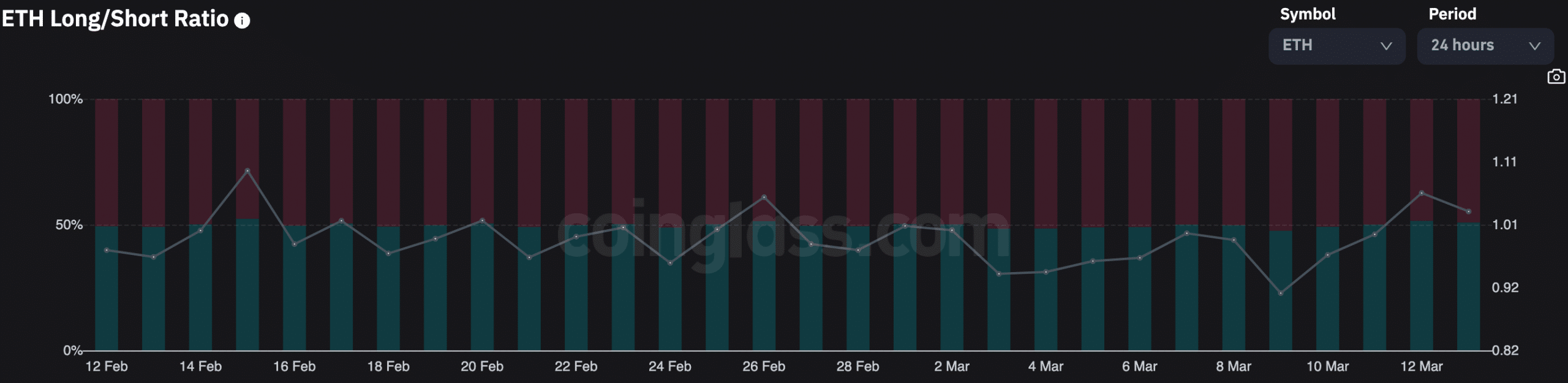

This surge in price impacted traders who were holding short positions against ETH.

In fact, according to Glassnode, the short liquidations for Ethereum on Binance hit a 2-year-high of $15.09 million.

At the time of writing, a significant majority of traders held positive sentiments. This was evidenced by the growing number of long positions being taken by traders for Ethereum.

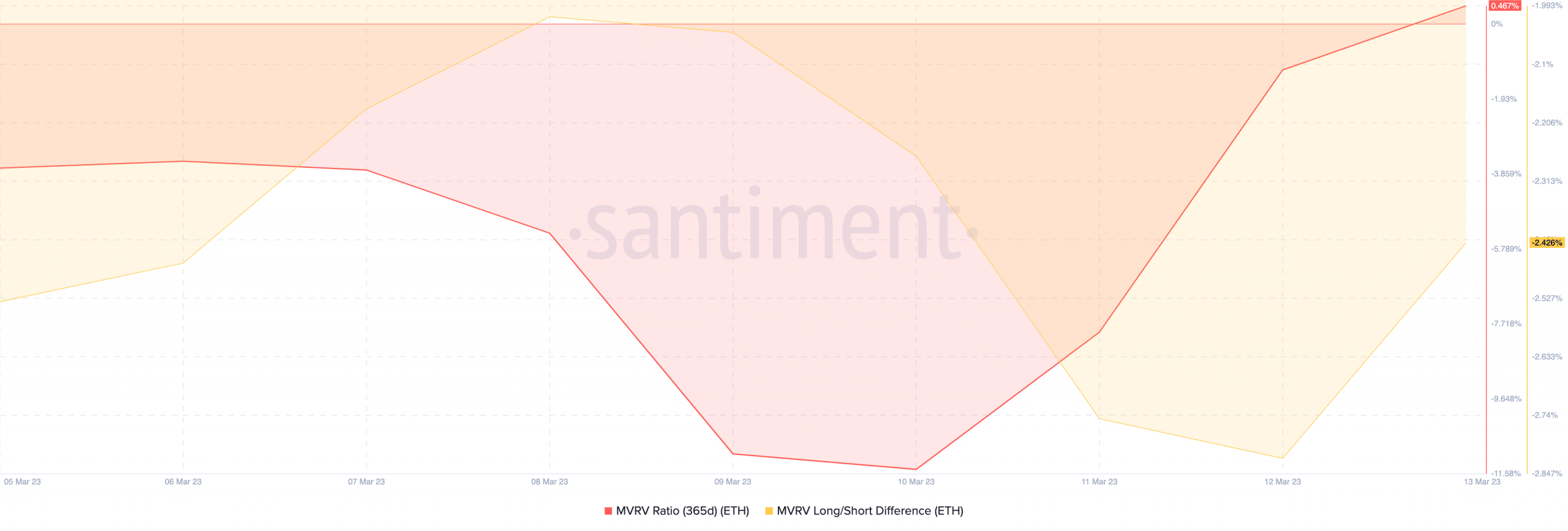

One of the reasons behind the growing number of long positions could be the fact that many addresses holding ETH are still not profitable.

📉 #Ethereum $ETH Number of Addresses in Profit (7d MA) just reached a 1-month low of 54,139,897.250

View metric:https://t.co/9t2b8JZFT0 pic.twitter.com/EO3tbPKwPB

— glassnode alerts (@glassnodealerts) March 12, 2023

The declining profitability, paired with a relatively low MVRV ratio, implied that many ETH holders will not be incentivized to sell anytime soon. However, If ETH’s price keeps appreciating at the rate seen over the last 24-36 hours, there is a chance that holders could face more selling pressure in the future.

Here, it’s worth noting that though Ethereum registered some volatility, the number of validators on its network hiked. Staking Rewards data revealed that the validators on the network hit a record high of 548,763 , representing a 6.4% spike.

Is your portfolio green? Check out the Ethereum Profit Calculator

Even though ETH’s price and number of validators are on the rise, the upcoming Shanghai hard fork on the network could fuel uncertainty. In fact, many in the market are already expecting massive fluctuations.

Keeping an eye on new developments on the network over this period will be advisable.