Asset managers ARK Invest and 21Shares have taken the first step towards launching an exchange-traded fund (ETF) directly holding Ether (ETH).

The two firms submitted an application to the US Securities and Exchange Commission (SEC) on Wednesday. They are seeking regulatory approval for their proposed Ark 21Shares Ethereum ETF.

A First for Ethereum ETFs

If approved, this would be the first Ether-based ETF available in the US with direct exposure to ETH, the second most popular cryptocurrency. In its application, the fund indicated plans to custody its ETH assets with Coinbase Custody Trust Company.

Furthermore, the application details that the ETF would store the majority of its Ether holdings in cold storage for security purposes.

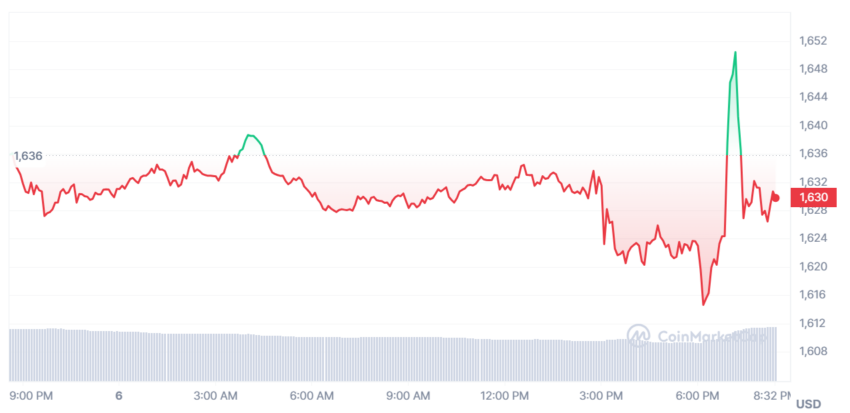

Following the news, Ether’s price saw a dramatic jump before falling down to approximately $1,630—roughly where it had been trading earlier in the day.

This application comes on the heels of a recent court victory by Grayscale against the SEC regarding a Bitcoin ETF.

The Court of Appeals found the SEC exceeded its authority and acted arbitrarily by requiring a surveillance-sharing agreement. This overturns the SEC’s 2022 denial of a proposed rule change to allow the listing.

Grayscale first applied to convert its closed-end GBTC fund into an ETF in 2021.

SEC Has Postponed Its Bitcoin ETF Decisions Until October

On September 5, Grayscale said it wants to meet with the SEC as soon as possible. It hopes to expedite the approval process.

Following the decision, the SEC announced it was delaying its decision on a range of spot Bitcoin ETFs. The review period has now been extended to October 17.

ARK Invest, founded by Cathie Wood, specializes in disruptive innovation investments and is notably bullish on cryptocurrencies, especially Bitcoin (BTC). The Ether ETF application is likely to garner significant publicity.

However, the SEC’s stance remains uncertain. It is unclear if the regulator will oppose the ETF or whether the saga will end up in court like its Bitcoin counterpart.

The post ARK Invest Files for First US Spot Ether ETF appeared first on BeInCrypto.