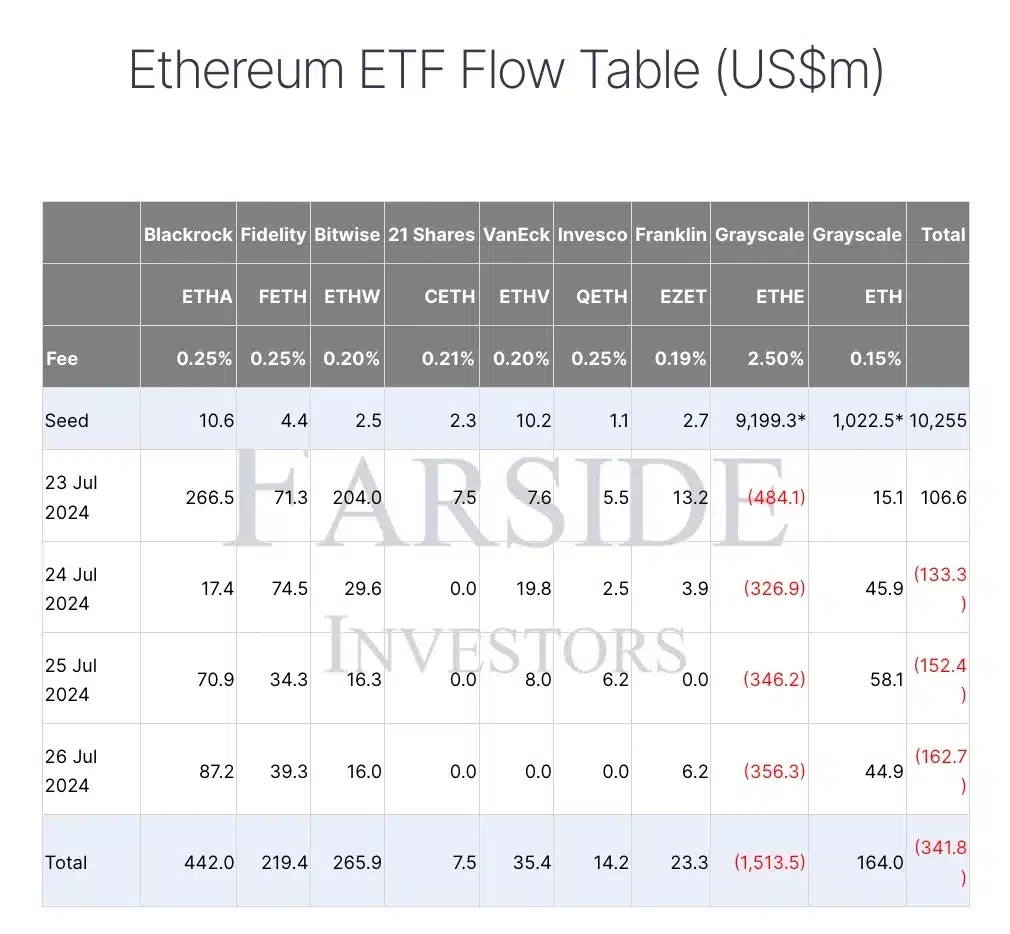

- Grayscale’s Ethereum Trust ETF saw $1.5 billion in outflows from the 23rd to the 26th of July.

- BlackRock’s iShares Ethereum Trust ETF attracted $87.2 million in inflows on the 26th of July.

Since the approval of the spot Ethereum [ETH] ETF for trading, Grayscale Ethereum Trust ETF [ETHE] has experienced significant outflows.

Grayscale breaks record

From the 23rd to the 26th of July, the ETH ETF saw total outflows exceeding $1.5 billion, with a single-day net outflow of $356 million on the 26th of July, according to Farside Investors.

This sharp decline highlighted a notable shift in investor sentiment and raises a question: Should investors buy ETH before Grayscale’s dwindling supply drives up the price due to higher demand?

In response to this, market analysts @CuratedByR noted on X (formerly Twitter),

“There is no easier trade than the ‘buy just before Grayscale runs out of $ETH ’ trade. Don’t overcomplicate things.”

Impact on ETH’s price

Addressing these concerns, AMBCrypto analyzed ETH’s market trends and found that the largest altcoin was trading at $3,366, reflecting a 4% increase over the past 24 hours, per CoinMarketCap.

The Relative Strength Index (RSI), positioned above the neutral level at 51, also indicated ongoing bullish momentum.

Additionally, the closing Bollinger Bands signaled decreasing volatility, reinforcing the expectation that the current bullish trend was likely to continue.

Source: TradingView

ETH ETF flow analysis

Grayscale’s Ethereum Mini Trust ETF (ETH) experienced a positive shift with a net inflow of $44.9 million on the 26th of July, bringing its total net inflows to $164 million since its inception.

Meanwhile, BlackRock’s iShares Ethereum Trust ETF (ETHA) had garnered significant investor interest, recording a substantial net inflow of $87.2 million on the same day.

As expected, this surge elevated ETHA’s total net inflows to $442 million, highlighting its leading position in the market.

Hence, despite Grayscale’s underperformance, investor optimism for ETH ETFs remained strong, thanks to inflows into other ETFs.

X user Joseph put it best when he said,