- Spot Ethereum ETFs recorded $11.4M in inflows for the first time in nearly three weeks.

- This comes as outflows from exchanges increased significantly, relieving the near-term selling pressure.

Spot Ethereum [ETH] exchange-traded funds (ETFs) recorded $11.4 million inflows on 10th September per SoSoValue data. This was the first time in nearly three weeks that the flows turned positive.

Wall Street giants BlackRock and Fidelity dominated the data with $4.31 million and $7.13 million inflows, respectively.

Despite the recent shift in sentiment, ETH ETFs have underperformed against their Bitcoin [BTC] counterparts with $562 million in cumulative net outflows since launch.

According to Glassnode, the performance of Ethereum ETFs has been “relatively tepid” because of redemptions from the Grayscale product. Nevertheless, these products have a smaller impact on trading volumes in the ETH spot market.

Ethereum exchange outflows reach multi-week peak

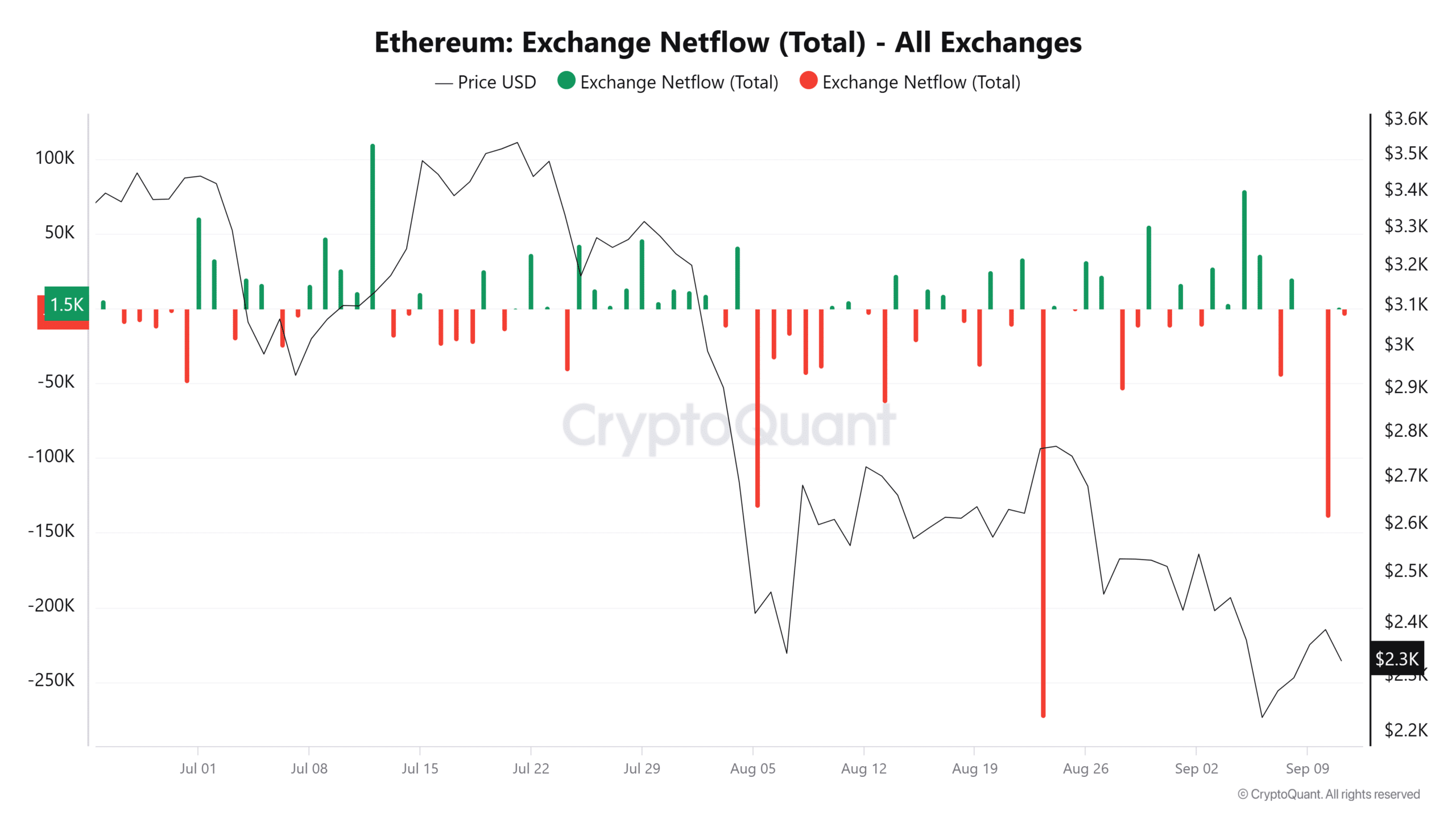

Data from CryptoQuant shows a surge in Ethereum outflows from exchanges. ETH exchange netflows reached 139,548 on 10th September, the highest level in weeks.

An increase in exchange outflows indicates fewer traders are interested in selling ETH in the near term. This relieves the selling pressure on the altcoin, and if demand increases, it could trigger a price increase.

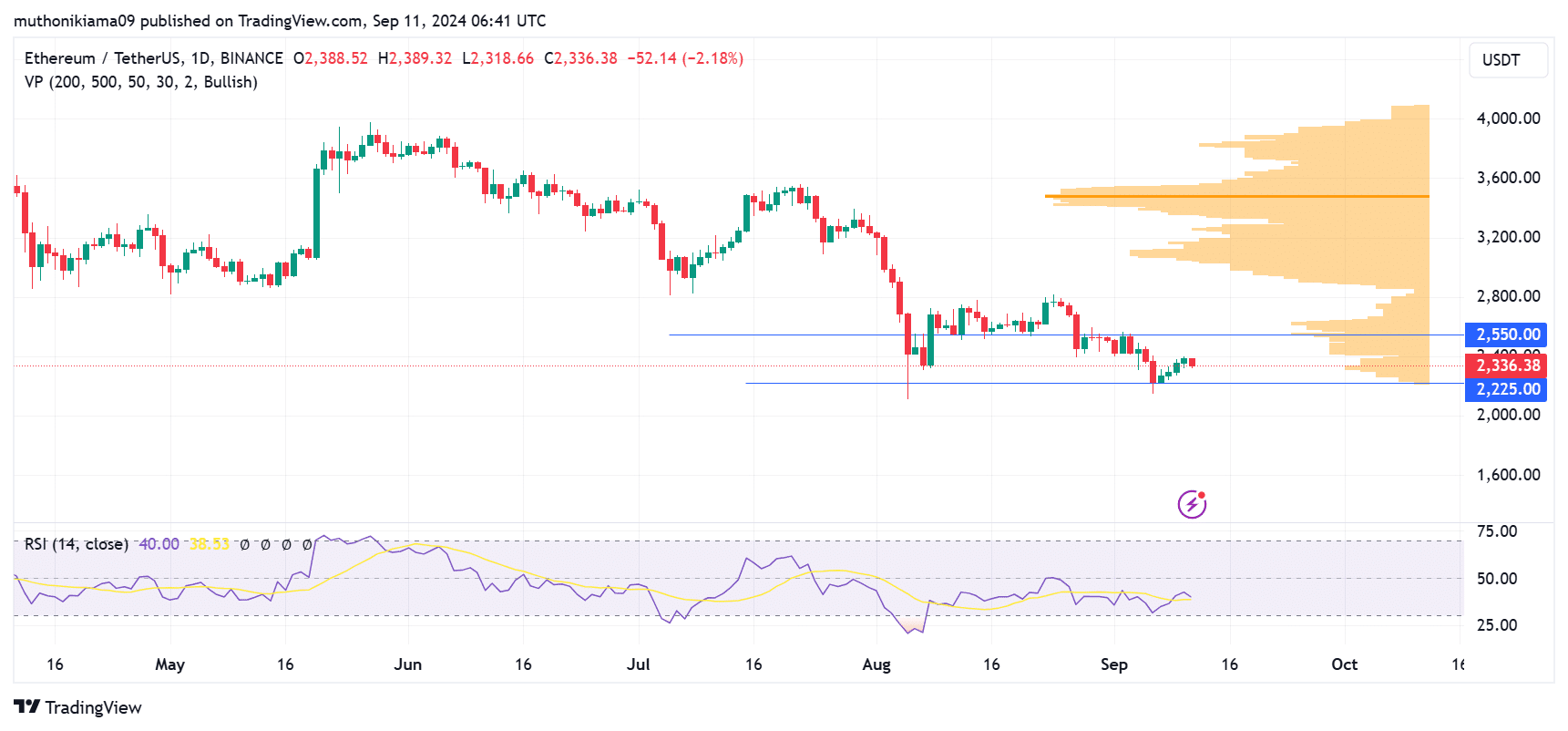

However, this surge in demand is lacking. The Relative Strength Index at 40 shows that selling momentum is significantly high. Moreover, the RSI is tipping south and risks crossing below the signal line, which could create a sell signal and trigger further dips.

Moreover, the volume profile data shows that bears might continue to dominate ETH price. There are significantly low buying volumes at the current price, which could see ETH consolidate at current prices.

If selling activity continues, the altcoin will possibly drop to test support at $2,225 before making a decisive move.

Buyers appear to be saturated at $2,550. This price acts as a key resistance level, with traders waiting for a breakout to confirm an uptrend.

ETH’s rally is also contingent on the performance of the Ethereum network if support from the broader market fails.

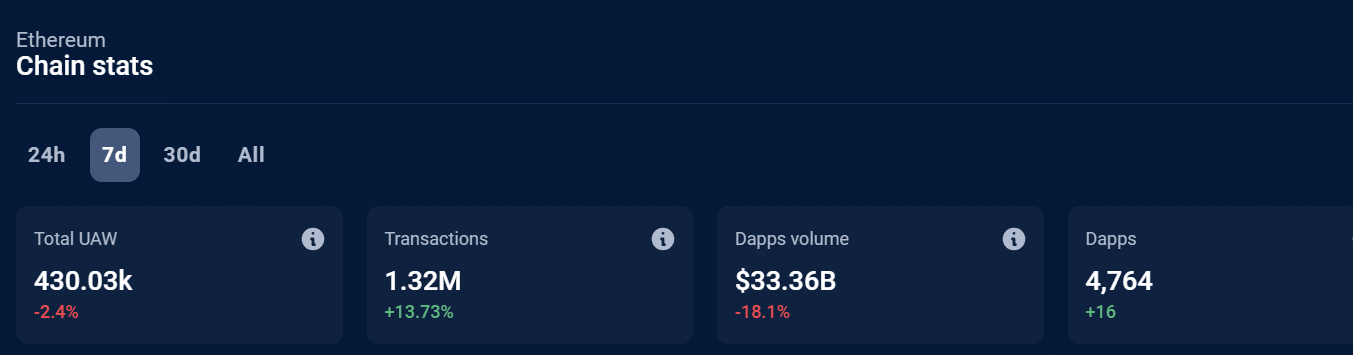

Data from DappRadar shows that the Ethereum network has been lagging in terms of volumes. In the last seven days, volumes for decentralized applications (DApps) created on Ethereum have dropped by 18% to $33 billion.

However, the blockchain saw a 13% increase in transactions during the same period This indicates that trading activity is increasing but there are fewer interactions on the network.