- Ethereum has now pushed below the lower boundary of its long-held trading range that has been formed throughout the past several weeks

- This weakness has come about as Bitcoin also inches lower

- Both of these digital assets have been maintaining above these levels over the past several weeks, and a firm decline beneath them would be grim

- One prominent analyst is pointing to the fact that ETH has formed a similar market structure to that seen in early-May before the crypto rallied from under $200 to highs of over $250

- The imminent expiration of a significant amount of Ethereum options could be one factor that triggers some volatility

Ethereum is now inching below the lower-boundary of a long-held trading range that it has been caught within.

Despite this being an overt sign of weakness, it is important to note that the cryptocurrency is forming a market structure that is strikingly similar to that seen prior to its rally from under $200 to highs of $250 earlier this month.

If history rhymes, this could mean that it is gearing up to make a significant push higher in the days and weeks ahead.

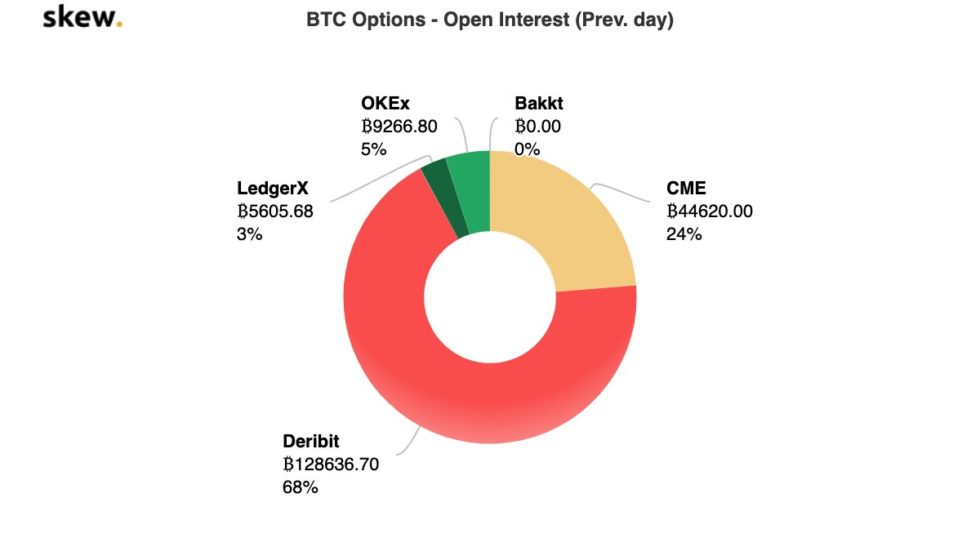

This volatility could be triggered by the imminent expiration of a combined $1 billion worth of Bitcoin and Ethereum options.

Ethereum Breaks Below Lower Range Boundary as Weakness Mounts

At the time of writing, Ethereum is trading down roughly 1% at its current price of $228.60. This marks a decline beneath the lower boundary of its previously formed trading range between $230 and $250.

A sustained decline beneath this level could be grave for the cryptocurrency and may spark its next downtrend.

Whether or not this occurs will likely be dependent on whether Bitcoin breaks below its support at $9,000. It is currently trading at just under $9,300.

The fate of both Bitcoin and Ethereum’s next trend may be determined in the near-future, as $1 billion in options for both cryptocurrencies are set to expire next week.

Image Courtesy of Skew

ETH Market Structure Flashes Similarities to That Seen Prior to Latest Rally

Luke Martin, a well-respected cryptocurrency analyst, explained in a recent tweet that Ethereum’s current price action is strikingly similar to that seen in May – prior to it breaking above $200 and rallying up to highs of over $250.

“For the ETH bulls: So far June’s price action is looking pretty similar to May before it made another leg higher… but it’s important to have a rule that lets you determine when the trend is fading. $225 is the line in the sand for me,” he explained.

Image Courtesy of Luke Martin. Chart via TradingView

If this price structure does result in an upwards movement similar to that seen in late-May, the crypto could make an attempt to rally up towards its yearly highs of $290.

Featured image from Shutterstock. Charts via TradingView.