Key Takeaways

- Born out of a hackathon in 2019, Zapper has grown to become a hub of activity for DeFi investors.

- Not only does it help users track their holdings, it also allows them to quickly react to new insights.

- Thanks to investment from the ever-present MetaCartel community, Zapper enjoys access to some of the most progressive minds in crypto.

Share this article

As the level of sophistication in DeFi and crypto rises, so too have initiatives to keep it user-friendly. Aggregators and top design teams are now working to corral all of the disparate pieces of a fast-paced niche. Born out of a hackathon in 2019, Zapper Finance is working in this exact space.

The platform has caught a second wind with the latest yield farming trend as users hunt down the best yields. As these returns can change daily, Zapper has become an essential tool for many farmers.

In this week’s installation, we’ll be diving into Zapper Finance. We’ll dig into what it does, how it works, as well as delve into the team behind the project and its thriving community.

What Is Zapper Finance?

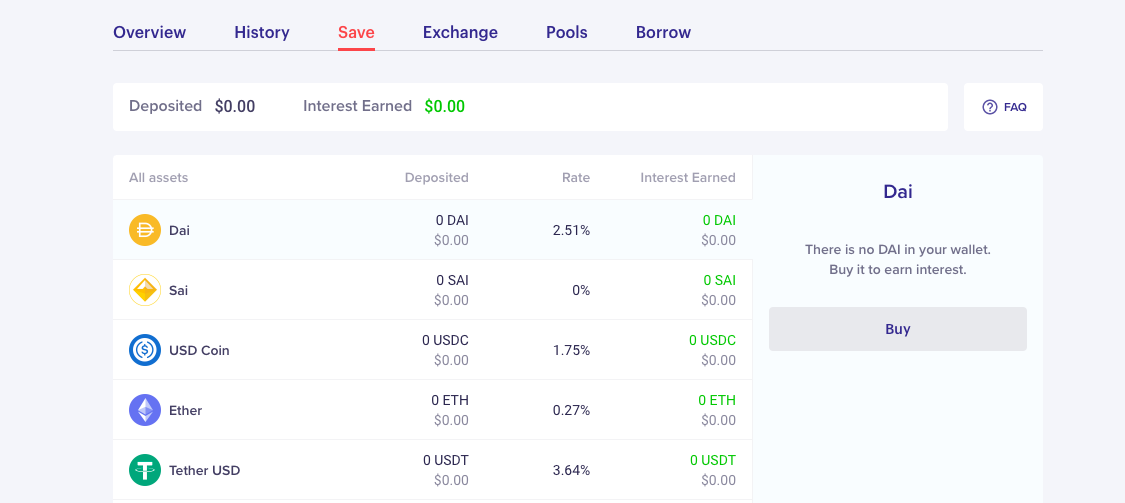

DeFi is tough to navigate without technical knowledge about Ethereum or how the various protocols that make up DeFi work. Zapper Finance helps resolve this by bringing simplicity to investing in liquidity pools while doubling up as a portfolio tracker.

Similar to Furucombo – the subject of a previous Project Spotlight – Zapper Finance’s goal is to bring the power of DeFi to the less technically inclined. Not everyone has the bandwidth to learn about the nuances of non-custodial finance. Thus, to bring DeFi to a broader audience, tools that abstract complexity are the need of the hour.

The core premise of Zapper Finance is allowing DeFi users to enter and exit a liquidity pool with one click. As a high-growth niche in DeFi, creating easy access to liquidity pools is a must for DeFi to scale and meet the needs of the many.

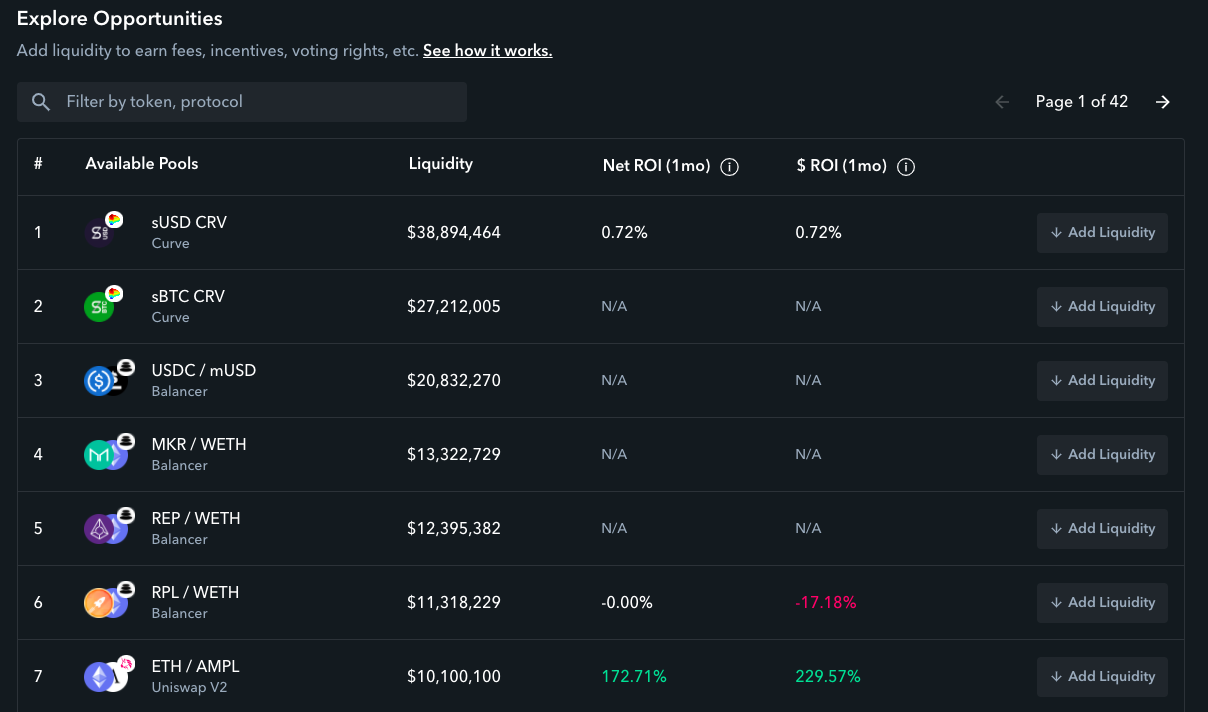

Using Zapper Fi, one can seamlessly “zap in” or “zap out” of a liquidity pool on Uniswap, Curve Finance, and Balancer. There will soon be functionality for Opyn, Shell Protocol, and FutureSwap pools.

The best part about using Zapper Fi is that it converts your ETH or ERC-20 tokens into the necessary tokens for each pool, saving users from having first to convert their holdings.

Here’s an example process flow for depositing funds in a pool using Zapper Fi:

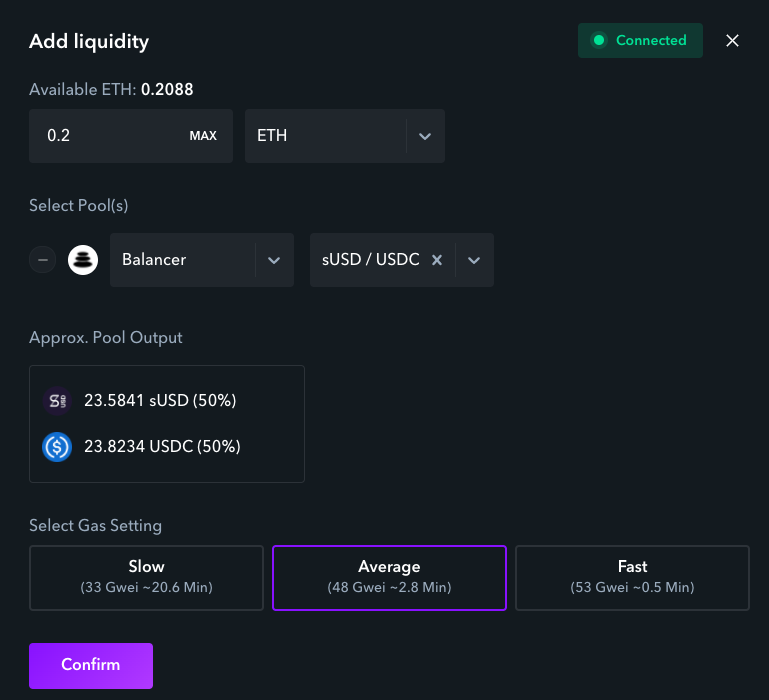

- Karen only owns ETH, but she wants to provide liquidity to Balancer’s 50-50 allocation sUSD/USDC pool.

- Instead of having to convert half her ETH into sUSD and the other half to USDC, she can leverage Zapper Fi to simplify the process.

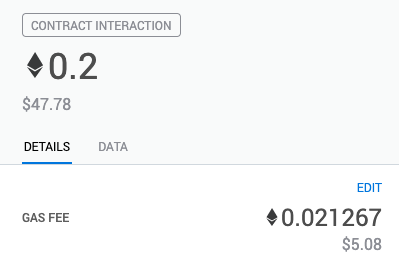

- Karen wants to deposit 0.2 ETH ($47.6 @ $238 per ETH) into the pool.

- Zapper Fi kicks in, splitting the ETH into $23.8 of USDC and $23.8 of sUSD. It then deposits the tokens into the Balancer pool from Karen’s address, and the Balancer pool tokens are credited to the same address.

To perform this operation, Karen only needed to pay $5.08 in fees as the average gas price hovered at 46 gwei. Without Zapper Fi, this would have cost at least $7-10 in fees.

Despite cutting out all the hard work for users, Zapper Fi’s most prized feature is its convenient dashboard, which is even used by those interacting directly with liquidity pools.

Block explorers only display an address” transactions; some like EtherScan take this a step further by showing user holdings. But none of them can hold a candle to Zapper Fi.

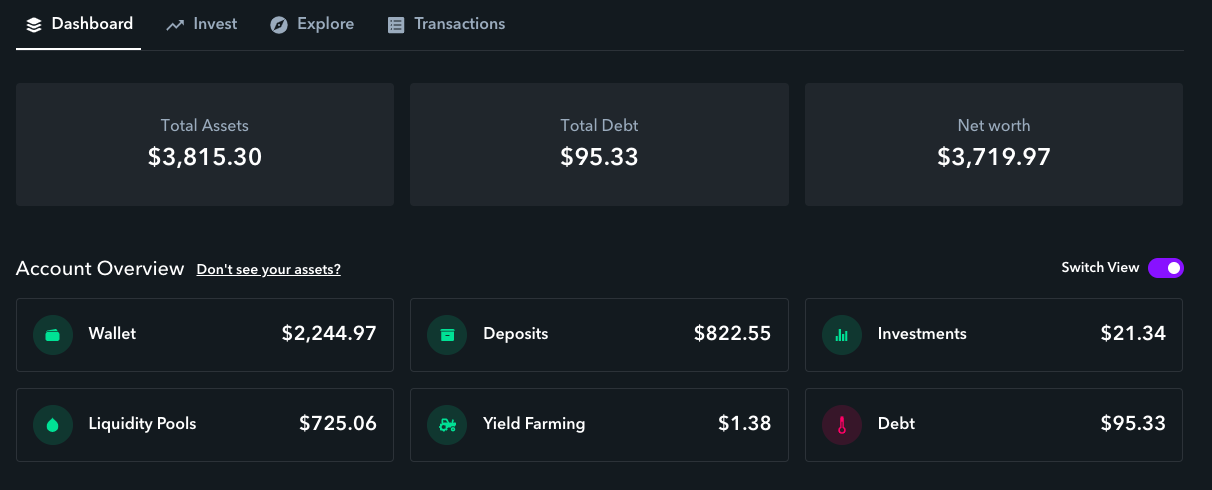

Zapper Fi’s dashboard tracks each address and breaks up its activity into six categories: wallet holdings, investments, liquidity pools, debt, yield farming, and deposits. This makes it far easier to navigate one’s portfolio and is augmented by an allocation table that shows a user how much money they have in each category as a percentage of the total.

Competition to Zapper Finance

Zapper Fi was conceived when DeFi Zap and DeFi Snap merged. This brought the ability to zap in and out of liquidity pools to the same platform as one of the space’s most revered portfolio analytics tools.

🥳EXCITING NEWS: @DeFiSnap + @DeFi_Zap are merging to create https://t.co/jSMMY8QHFG – the ultimate hub for DeFi⚡️

🆕Website: https://t.co/jSMMY8QHFG

🆕Documentation: https://t.co/71SMo20Eg7

🆕Feature: Multipooling🧲https://t.co/cXMpWwOBJ2Why Snap+Zap? Thread 👇 pic.twitter.com/4ZhN2ucRmP

— Zapper.Fi ⚡️ (@zapper_fi) May 1, 2020

There are standalone platforms that rival each of Zapper Fi’s products.

Pools.fyi is an interface that displays relevant information concerning liquidity pools. It also links users to a protocol’s front end, where they can add or remove liquidity. But it doesn’t have native liquidity provision capabilities like Zapper Fi. There are also several DeFi dashboards, including DeBank and MyDeFi.

But in terms of matching up to both of Zapper Fi’s products, there’s only one real competitor: Zerion.

Zerion has a native dashboard to track DeFi portfolios, and it also enables users to enter and exit liquidity pools on Uniswap and Bancor. However, Zerion’s service offerings span beyond just liquidity provision.

Integrations with 0x, Maker, and Compound gives Zerion’s users the option to lend funds, take out a loan, or exchange assets from a single platform.

How Zapper Fi Differentiates From Its Competition

While Zerion offers more features and has a suite of DeFi services under one roof, there are still demerits that hold it back. Borrowing is only supported on Maker and Compound, while lending is possible only through Compound. These features discount Aave, which has become a formidable competitor to both Compound and Maker.

Moreover, lenders are better off using iEarn Finance or RAY by Staked to get the best rates in DeFi. The only aspect that makes sense is asset exchanges, as they are powered by 0x – a liquidity aggregator that can split trades to draw liquidity from various DEXes.

Zapper Fi took the more refined approach, focusing on one segment and doing it well. While Zerion supports Uniswap and Bancor pools, Zapper Fi integrates Uniswap, Balancer, and Curve – the top three AMMs by liquidity.

Zapper Fi has added functionality by allowing users to act on incentivized pools without leaving the platform.

For example, Ampleforth’s’s incentivized AMPL-WETH pool on Uniswap requires liquidity providers to first deposit equal amounts of AMPL and ETH/WETH on Uniswap, then lock the corresponding Uniswap pool tokens in Ampleforth’s’s Geyser/Beehive program.

With Zapper Fi, this is a one-step process. Apart from giving users access to the most liquid pools, it also abstracts away added complexity when it comes to incentivized pools.

Further, the list of supported platforms says support for Compound and Aave is “coming soon.” This indicates Zapper Fi isn’t always going to have a narrow focus but is taking a slower approach to integrations.

Zapper’s decision to gradually integrate DeFi protocols makes sense from a security angle.

Transaction cost savings further exacerbate the product’s advantages. No competing service converts funds into the necessary tokens for a liquidity pool as Zapper Fi does. Unless you’re already holding the required tokens to provide liquidity to a pool, Zapper Fi is a smoother, more cost-friendly choice.

Potential Drawbacks

Zapper Fi’s focus on one segment, liquidity provision, means it cannot capture a large share of DeFi users. Liquidity provision is a large portion of DeFi activity, but other areas such as money markets and synthetic assets are scaling rapidly.

Like Furucombo, Zapper is a DeFi product – not a protocol. This means it cannot be decentralized, even though it’s’s completely non-custodial. But as a result, there are no real flaws with Zapper Fi since it doesn’t need to trade-off decentralization with efficiency or worry too much about security.

Community and the Zapper Finance Team

The DeFi community has rallied around the Zapper Fi product, especially in the wake of the yield farming craze. With so many variable crypto combinations, an easy-to-use dashboard revealing the highest yields is incredibly useful. Allowing users to capitalize on these yields in one click is even better.

Though there are a handful of one-stop DeFi shops emerging, Zapper Fi’s community is perhaps the largest and most established. While it is easy to learn more about this community on Twitter, Telegram, and Discord, many people from all around the crypto space have contributed to make Zapper a reality.

It is in this collaboration that bystanders also get a glimpse into how interconnected the DeFi and Ethereum communities are.

There are official co-founders, however. They are Seb Audet, Suhail Gangji, and Nodar Janashia. Each of them has a strong background in UX design, crypto development, and financial management, respectively.

Before forming Zapper, Audet helped build DeFi Snap, a dashboard that allowed users to view their DeFi activity on one simple interface.

Gangji and Janashia worked together to found DeFi Zap, a similar product that allows users to create bundled transactions to interact with multiple smart contracts simultaneously. After answering a few questions to assess users’ investment profile, DeFi Zap would suggest a few “zaps” that users could use to express their crypto sentiment.

DeFi Zap won the top prize at Kyber’s DeFi Hackathon, earning the team $5,000 in KNC tokens in November 2019. After starting an educational project called DeFi tutorials, Janashia reached out to other like-minded individuals to help build something for the hackathon. He recruited two individuals: Dipesh Sukhani, now a blockchain developer at 1x.exchange in Singapore, and Tosh Sharma.

Earlier this month, MetaCartel Ventures, a DAO-based venture capital collective, invested $50,000 into Zapper.

We are proud to announce our 2nd investment as a DAO, into Zapper Finance (@zapper_fi), an interface that makes DeFi easy and simple to use ⚡️

:: [ Originally a MetaCartel grantee, we are proud to back them on their next leg of the journey ] ::https://t.co/Lu3FlPmHtz

— METACARTEL VENTURES (@VENTURE_DAO) July 3, 2020

Though the fresh capital will help move the project forward, Janashia said that the investment was “more about expanding our network and partnering with the best builders and researchers from our industry.” MetaCartel had earlier stepped after the hackathon to help with a smaller grant and keep the project running.

Indeed, Janashia’s’s comments have held. Since earning MetaCartel’s investment, the team has attracted contributions from other big names in the crypto industry.

Cooper Turley, an editor at DeFi Rate, has helped consolidate information around the project. Brian Flynn, the founder behind RabbitHole, has helped with design, and Pavel Svitek, a senior software engineer at PwC Switzerland, helped improve Zapper’s source code.

Moving Forward

With the DeFi boom in full swing, projects like Zapper are sure to thrive. Competitors may emerge, but ousting the platform entirely may be difficult given the ever-evolving nature of Zapper. Since the July cash infusion from MetaCartel, the team has already added new features.