- ETH bears are losing momentum after a strong pullback in the last few days.

- ETH exchange balances reach 4-year lows as outflows continue.

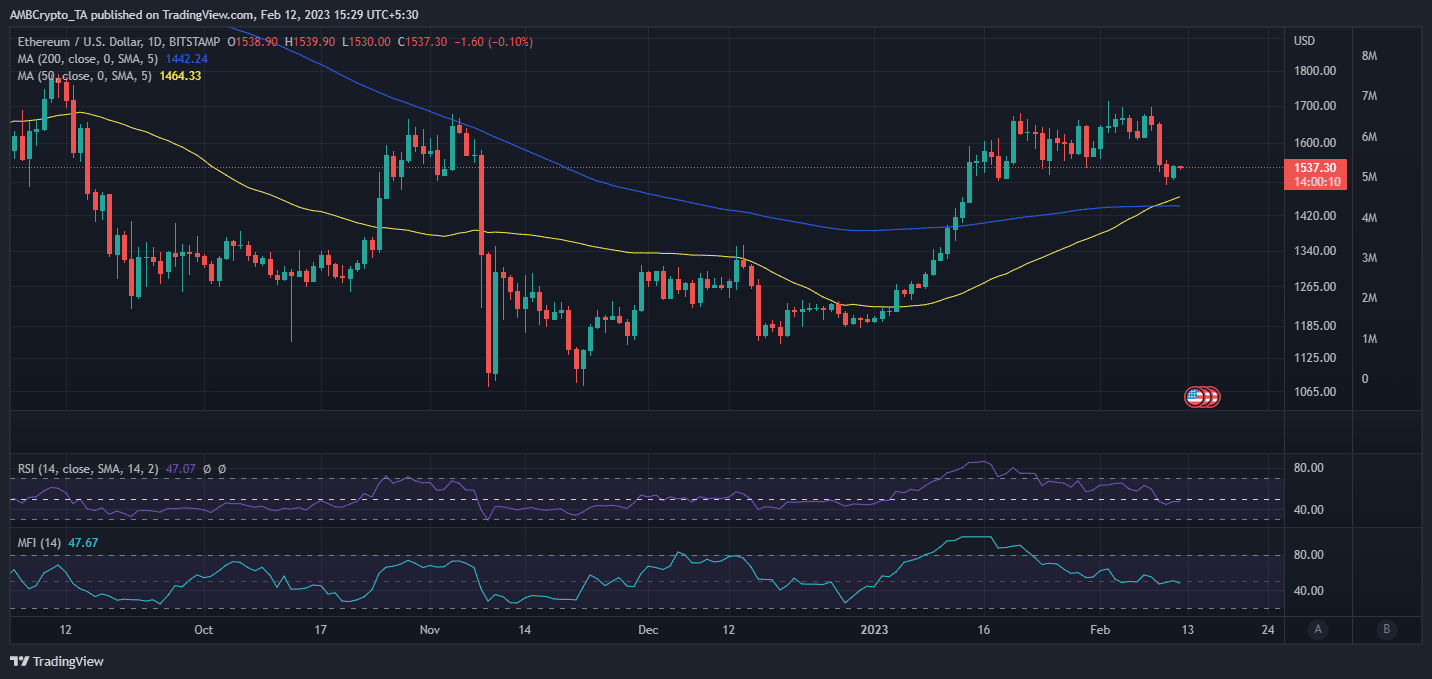

Ethereum’s native cryptocurrency just concluded the week with a sizable bearish pullback. There is more directional uncertainty as a result, but multiple indicators and metrics may offer some much-needed clarity.

How much are 1,10,100 ETH worth today?

For perspective, ETH’s $1534 price tag represents a 9% pullback within the last five days.

A couple of things to note about the price action- The pullback puts it within the 50% RSI level and the bears seem to have lost most of their momentum at this level. In addition, the outflows indicated by the MFI are leveling out.

More importantly, ETH’s 50-day Moving average recently crossed above the 200-day MA from below, forming a golden cross. The latter is a bullish sign, hence this may yield bullish expectations among investors.

Do ETH bulls have a chance to regain dominance?

Some of ETH’s on-chain metrics are leaning in favor of bullish expectations. The latest Glassnode alerts reveal that the cryptocurrency has been flowing out of exchanges. ETH’s balance on exchanges tanked to a 4-year low of 18,946,696.667 ETH.

📉 #Ethereum $ETH Balance on Exchanges just reached a 4-year low of 18,946,696.667 ETH

Previous 4-year low of 18,948,275.315 ETH was observed on 11 February 2023

View metric:https://t.co/1dCpD2ey8E pic.twitter.com/45yugPfDec

— glassnode alerts (@glassnodealerts) February 12, 2023

Most of the ETH flowing out of exchanges is likely headed into DeFi. This may explain the total value of ETH locked in ETH 2.0 deposit contracts just soared to a new ATH.

This is important because it confirms that ETH holders are more confident in allowing their coins to stay in DeFi. A sign of a favorable shift towards longer-term expectations.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 15,792,103 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/Ydzv8JmVY5

— glassnode alerts (@glassnodealerts) February 12, 2023

Assessing the level of ETH demand in the market

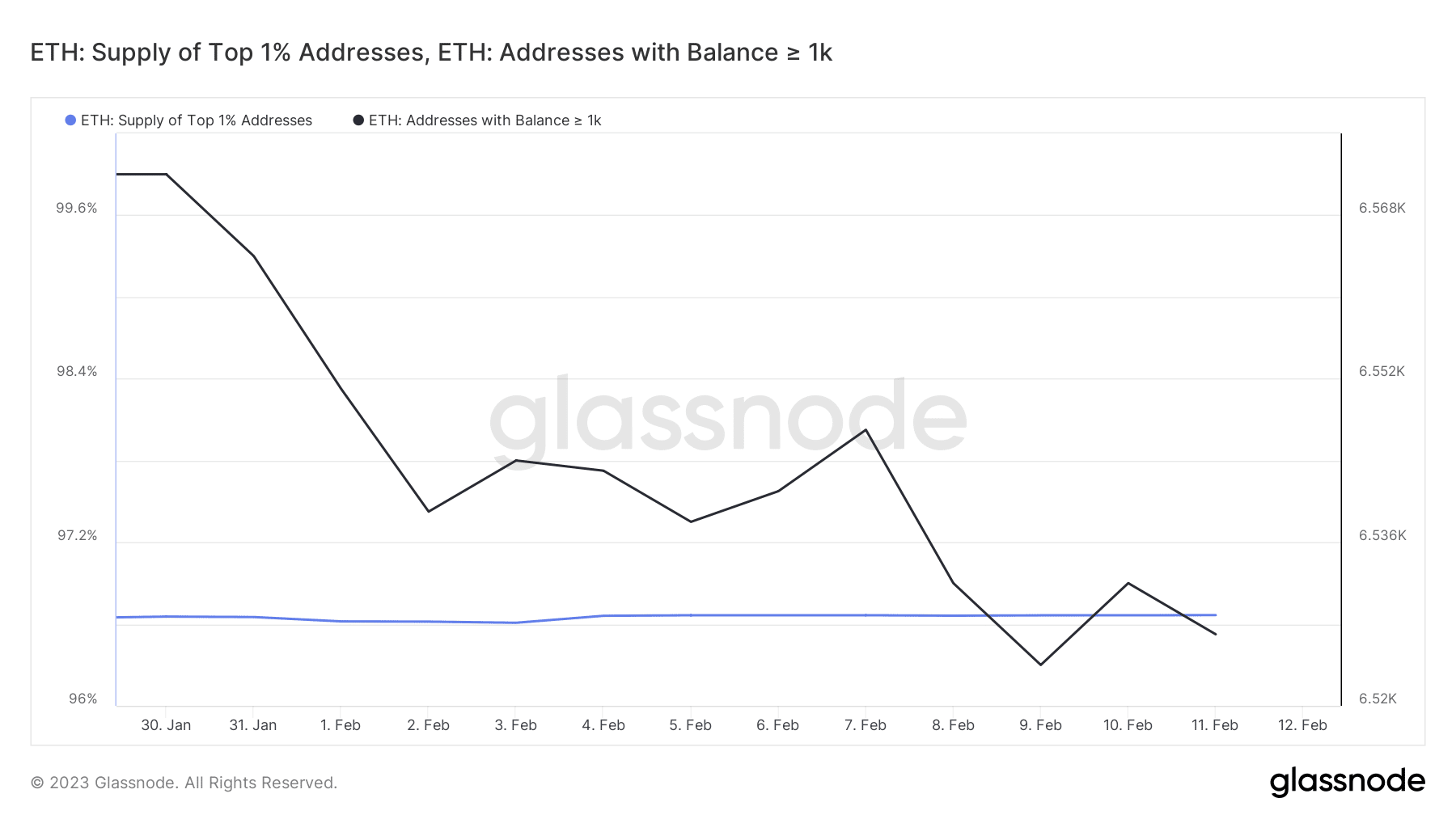

The supply of ETH held by the top 1% of addresses registered a slight increase in the last few days.

Meanwhile, the number of ETH addresses holding over 1,000 coins grew slightly in the last three days as opposed to the downside registered since the start of February.

This confirms that the bears are no longer in control and the taps causing sell pressure are running dry. But what about the demand situation on the derivatives side of things?

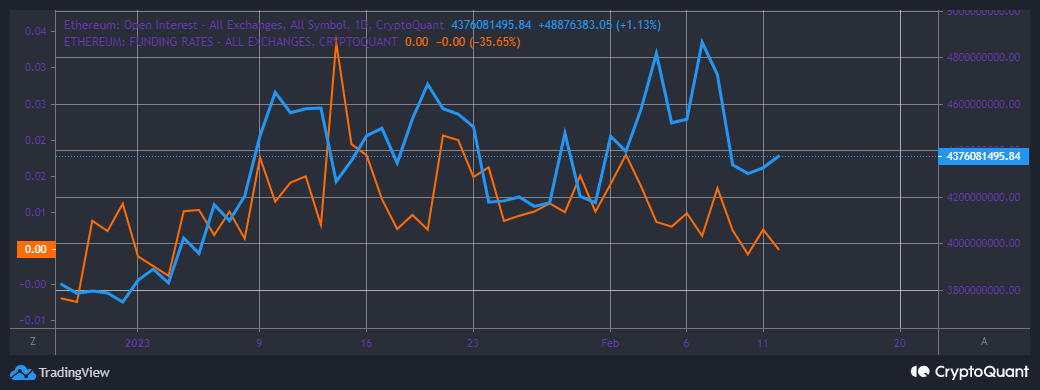

We did see a drop in open interest in the second half of last week but it is now pivoting in favor of the upside. In other words, open interest is returning as the price is showing bullish signs.

Is your portfolio green? Check out the ETH Profit Calculator

The funding rate still has a downward trajectory, likely indicating a lack of strong demand. The above metrics and indicators point toward a possible bullish outcome.

However, this is subject to the lack of more FUD potentially triggering another unexpected selloff.