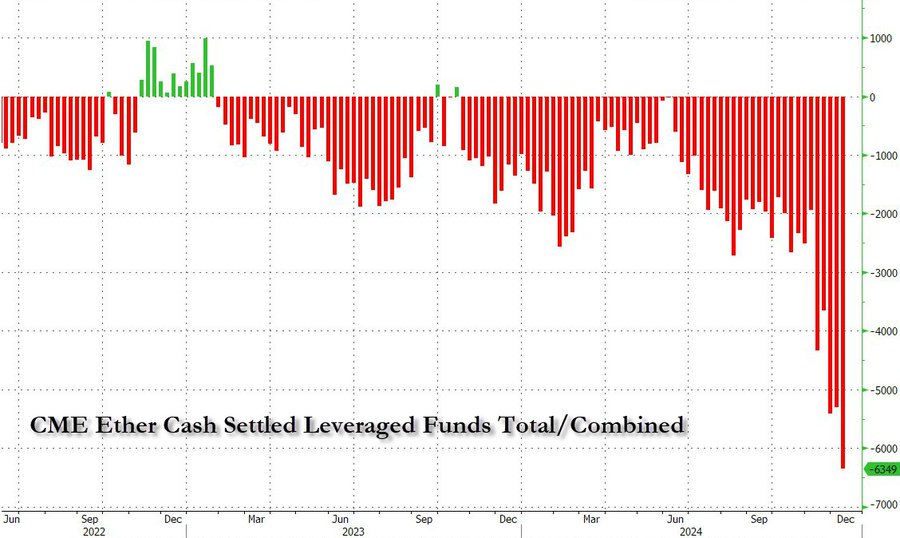

Hedge funds have set a new record for shorts against Ethereum on the Chicago Mercantile Exchange (CME), driving these positions to an all-time high.

This development comes as Ethereum struggles to maintain momentum above the $4,000 mark despite a strong influx of funds into spot ETFs and generally bullish market sentiment.

Ethereum Faces Record Short Bets Despite Bullish ETF Inflows

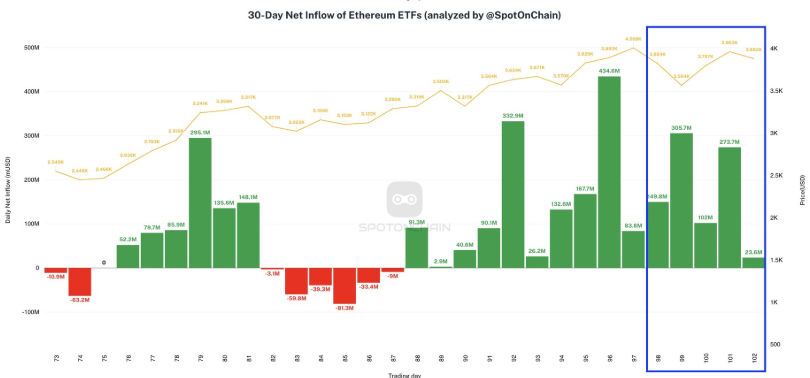

Over the last three weeks, Ethereum ETFs have recorded consistent inflows, amassing over $2 billion in new funds. According to SpotOnChain data, this streak included a record-breaking weekly inflow of $854 million, the highest since the product’s launch. These developments have sparked optimism among some market participants.

However, this inflow of funds has not translated into a significant price rally for Ethereum. Instead, the cryptocurrency’s price performance remains subdued, raising questions among investors.

Analysts attribute this to the increasing net short positions in CME Standard Ethereum Futures contracts, which reached a record 6,349 contracts, according to data from Zerohedge. These short positions are typically used to profit from price declines, signaling a cautious outlook on Ethereum’s short-term potential despite the broader market’s enthusiasm.

While hedge funds bet against Ethereum, long-term market sentiment remains positive. Many traders anticipate Ethereum could surpass its previous all-time high because its market fundamentals remain strong.

Indeed, blockchain data from CryptoQuant suggests Ethereum’s realized price upper band sits at $5,200, indicating the potential for upward movement as supply-demand dynamics evolve.

“The realized price upper band, currently at $5.2k, matches the level seen during the 2021 bull run peak, signaling strong potential for further growth,” the firm stated.

Moreover, Ethereum’s network activity reflects sustained interest. Analytics platform Santiment reports that over 130,000 new Ethereum addresses were created daily in December, marking an eight-month high.

As a result, IntoTheBlock data shows that Ethereum’s weekly transaction fees surged to $67 million, their highest since April, driven by robust DeFi activity and market adjustments following a recent $100,000 market retracement.

The post CME Records All-Time High Ethereum Shorts Driven by Hedge Funds appeared first on BeInCrypto.