The “no-loss lottery” concept pioneered by PoolTogether has gained significant traction in recent months. With a fresh $1M equity injection and a new USDC pool coming to the protocol, PoolTogether is aiming to build a DeFi primitive for the ages.

PoolTogether Offers Crypto Lottery Tickets

If an avid user of DeFi had just a few DAI in their wallet, there would be no reason for them to deposit it into a money market such as Compound.

Rather, if the user deposited these funds into PoolTogether’s contract in exchange for lottery tickets, they set themselves up for a healthy windfall.

Even a small deposit can yield returns upwards of $1,000 a week and the current pool estimates a $1,530 payout this week.

More importantly, even if a user doesn’t win, they get their deposit back, according to a blog post from PoolTogether.

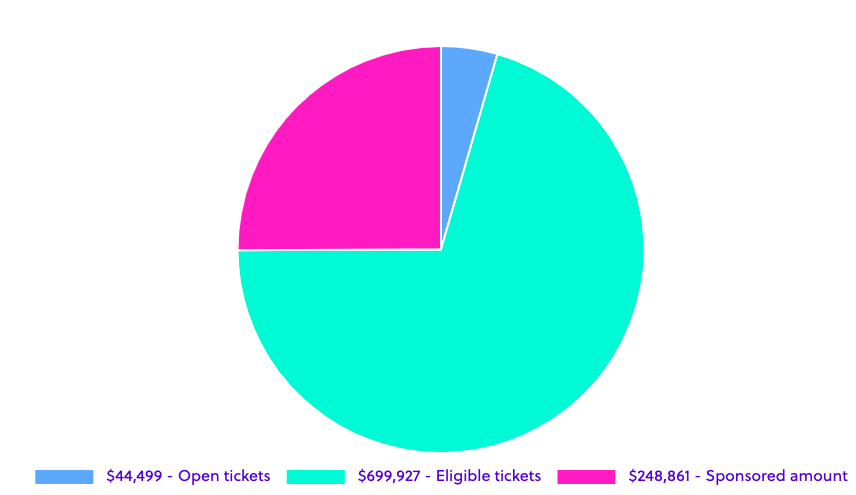

The current pool has approximately a million dollars of DAI in total locked in it. A majority of this comes from sponsored funds, meaning they merely provide liquidity and do not take part in the lottery. Thanks to this, the odds of winning are favorably shifted towards the small token holders who otherwise would have much lower odds.

More than just users are excited about these prospects, too.

IDEO Lab Ventures led a million-dollar investment round in PoolTogether, along with the likes of ConsenSys and DTC Capital. This investment is not directly in the protocol either. Instead, it will provide investors with future equity stakes.

PoolTogether has been criticized for various reasons. Some in the Ethereum community believe it to be a waste of productive capital, while others scorn the protocol’s closed codebase.

The most profound criticism, however, is that PoolTogether’s contracts are upgradeable by the team, implying they can change the contract and withdraw the funds. As per an audit disclosure, the protocol uses a 2 of N Gnosis multisig wallet, which simply means only two team members need to sign off before the contract can be changed.

PoolTogether’s efficiency comes from the use of idle funds.

If one were to compute the yield of, say, 10 DAI worth of tickets in the lottery, the probability would come close to earning the typical DAI yield on Compound.

At 699,927 lottery tickets (each DAI representing one ticket), the probability of a single ticket winning the pool is 0.00000142. A user’s odds of winning increase as they purchase more tickets, but they also forego more guaranteed yield from lending the funds elsewhere.

While it appears clear which platform a rational user would select, humans – not just in the cryptocurrency market – have proven they’re irrationality time and again. The use of non-participating sponsored funds to increase payouts in the reward process adds to this phenomenon.

Ultimately, lump-sum payouts for a small deposit that a user can’t lose sounds far too alluring for most to surrender.

And this is precisely why PoolTogether has gained so much traction.