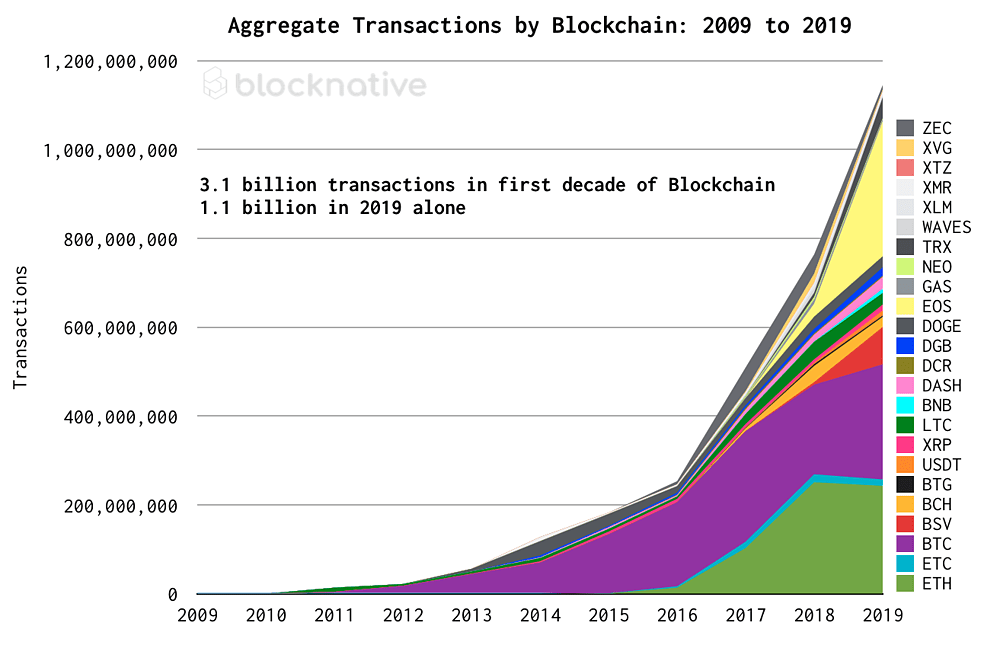

The cryptocurrency market has made great progress since the conception of Bitcoin in 2009. Crypto-traders in the market have seen the market at its best and its worst, opting to look at the positives and march on. The growth in crypto-use has been multifold over the decade and the same was reflected when aggregate transactions per year surpassed the 1 billion mark in 2019.

According to data provider Blocknative, 2019 turned out to be the most popular year in the history of crypto-transactions. In its recent research, the report claimed,

“Significantly, we crossed the 1 billion aggregate transactions per year threshold in 2019. In fact, more than 37% (>1.1 billion) of all blockchain transactions in history occurred in 2019.”

Source: When One Billion Ethereum Transactions?

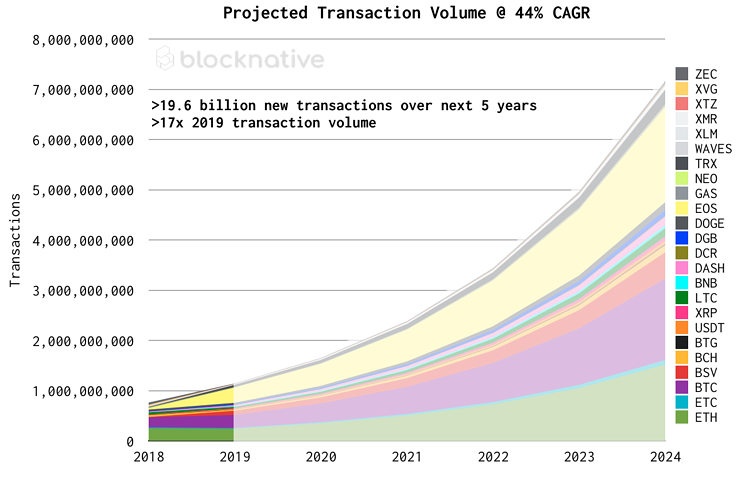

The attached chart reflected the growth in Bitcoin and Ethereum transactions over time. According to the report, in 2019, BTC and ETH represented nearly 44% of the total global blockchain transaction volume, with the crypto-industry growing at a 5-year

Compound annual growth rate [CAGR] of 44%. If the current trends continues, the industry could expect almost 20 billion new blockchain transactions over the course of the next 5 years.

Source: When One Billion Ethereum Transactions?

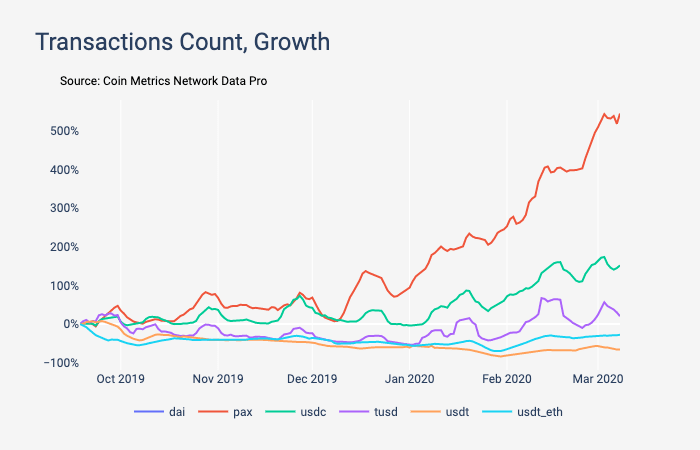

Shifting its focus onto stablecoins, the report said that Tether [USDT] has emerged as the go-to stablecoin in the crypto-market. Over the last 180 days, Paxos [PAX] outgrew Omni-issued Tether [USDT], Ethereum-issued Tether [USDT_ETH], USD Coin [USDC], and TrueUSD [TUSD] in terms of daily transactions count, according to data provider Coin Metrics.

As USDT and USDT_ETH’s growth was restricted and fell to a certain extent, over the past 180 days, PAX grew by about 545%.

Source: Coin Metrics

Despite falling lower on the prominence table, however, USDC managed to lead in terms of adjusted transfer value growth as it grew by 80%, as much as PAX.