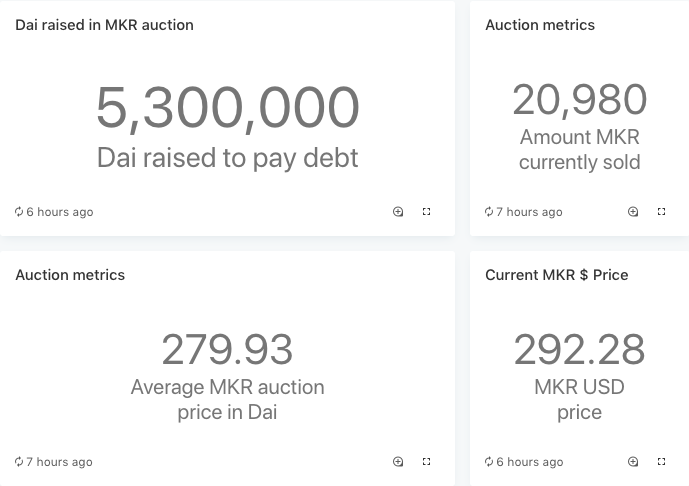

The MakerDAO’s auction of MKR tokens raised over $5.3 million to negate the Dai deficit caused by “Black Thursday.” Despite a successful auction, Maker still faces a challenging road ahead to regain users’ trust after the March carnage.

Two Buyers Restore Dai Deficit

After concluding the auction, the MakerDAO has raised enough money to completely offset the protocol’s debt. “Free” collateral auctions during Ethereum network congestion on Mar. 13 caused the deficit.

The auction conducted by the MakerDAO was meant to sell MKR, the protocol’s governance tokens, to anyone willing to bid the highest for it. If a variety of bidders took part in the auction, trying to secure some MKR, it would’ve been a sign that investors still believe in Maker’s ability to dominate DeFi.

Paradigm, a crypto-based investment firm and existing MKR holder, announced that they had won over 72 out of 106 auctions, representing 68% of the total number of auctions. After some on-chain investigation, The Block found that the Maker Foundation won the first 33 rounds of the auction.

Those who attack EOS for being centralized are the same people who applaud MakerDAO’s governance model.

Less than 20 whales decide MakerDAO’s governance. EOS has 21 block producers.

My question: At what point does a distributed system become decentralized? Who decides?

— DeFi Dude 🕶️ (defidude.eth) (@DeFiDude) March 31, 2020

This means that Paradigm and the Maker Foundation together won 105 out of 106 auctions, leaving just one action left. It is unknown if both entities aggressively bid to win these auctions, or if nobody was willing to match their bid prices.

There were 33 unique addresses that bid in the MKR auctions, many of which could belong to a single entity.

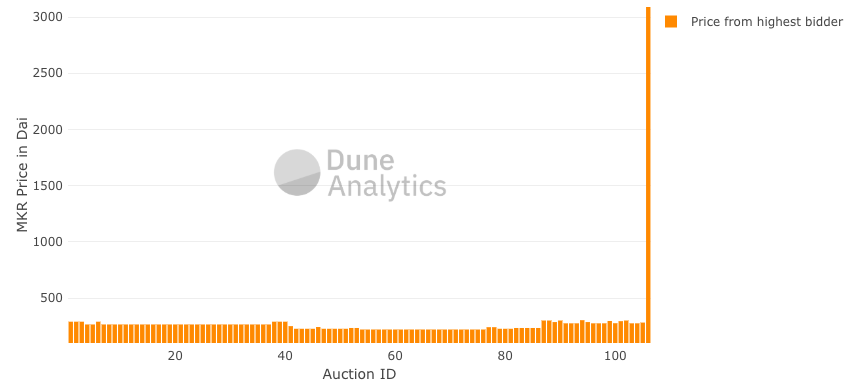

The last auction received a bid for 3,090 DAI per MKR – a large anomaly from the 279 DAI average.

DAI Peg Still Not Restored

The second, and more important, sign that confidence in the system has not yet returned is the loss of DAI’s peg to the dollar.

Since Mar. 13, DAI dropped one time below $1 and has since traded between $1.01 and $1.04. While this provides unique arbitrage opportunities, a stablecoin that doesn’t obey its peg is unhelpful.

MakerDAO governance actions to incentivize users to sell DAI in the open market, thus restoring parity with the dollar, have also failed to generate meaningful results. After several CDP and Vault borrowers were mercilessly liquidated for the full sum of their collateral, faith in the system is broken and needs to be rekindled.

However, there has been no discussion to take action that helps these liquidated borrowers. For Maker to continue to thrive, they must convince borrowers that they can provide better safety nets.

Governance is now in the hands of MKR holders after the Foundation transferred the totality of its power to the token. What the community of MKR investors do now will set the tone for Maker’s recovery.