After incurring an incredibly intense uptrend that led Ethereum to highs of over $175 yesterday, ETH has lost some of its momentum and has declined below $170, with this drop coming about concurrently with that seen by Bitcoin overnight.In the near-term, it does appear that ETH’s bulls may have slightly overextended themselves, as the crypto is currently flashing some signs of technical weakness.In spite of this, it is important to note that there is one fundamental factor that could bolster Ethereum in the days and weeks ahead, with its continually rising futures trading volume being a sign of vitality amongst investors.Ethereum Inches Lower as Technical Strength Flashes Some Bearish Signs At the time of writing, Ethereum is trading down just over 1% at its current price of $168, which marks a notable decline from daily highs of over $175 that were set at the peak of the recent rally.ETH’s drop from these highs has come in tandem with that seen by Bitcoin, which has fallen from highs of $7,500 to its current position within the lower-$7,000 region.In the near-term, Ethereum’s decline from these highs does seem to suggest that bulls have lost their momentum, and that the crypto may need to move back towards the lower-$100 region before it finds enough support to extend its uptrend.One analyst mused this possibility in a recent tweet, explaining that the crypto may test $125 or even $110 before it continues climbing higher, with its key resistance hurdle currently existing around $185.“Ethereum: Nice break to the upside, but not convinced we won’t see $125-130 for tests (or $110) for confirmation. Next hurdle to take is the $185-193 area. Looking for shorts in these zones (confluent with BTC movements). Holding $151-155 = long entry time.” Image Courtesy of Crypto MichaëlETH Sees Growing Activity Amongst Futures Traders: Bullish?One fundamental factor that should be considered in the near-term is that ETH has seen rising futures trading volume across the board over the past few days, with this coming about in tandem with its recent rally.According to data from research platform Skew, Ethereum’s futures volume is at levels not seen since the immense volatility incurred on and around March 12.

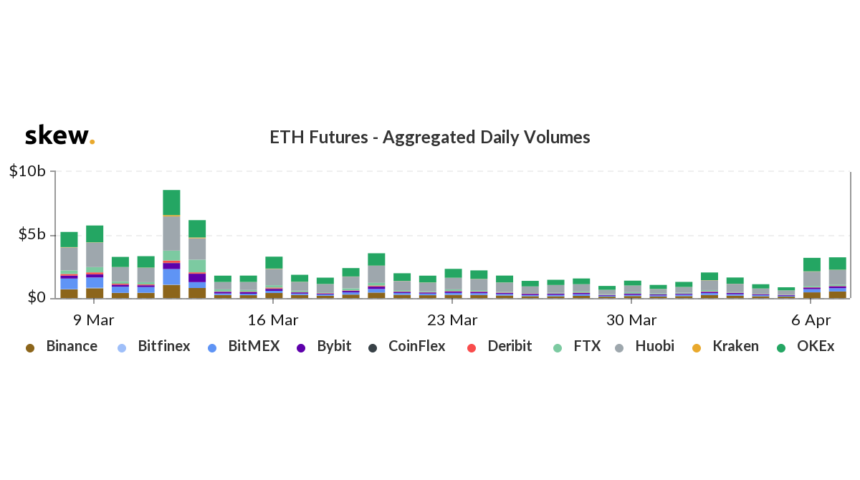

Image Courtesy of Crypto MichaëlETH Sees Growing Activity Amongst Futures Traders: Bullish?One fundamental factor that should be considered in the near-term is that ETH has seen rising futures trading volume across the board over the past few days, with this coming about in tandem with its recent rally.According to data from research platform Skew, Ethereum’s futures volume is at levels not seen since the immense volatility incurred on and around March 12. Image Courtesy of SkewFutures volume tends to climb when traders believe that an asset’s movement is significant for its future prospects, with this ongoing rise suggesting that traders likely believe that this latest movement altered its underlying market structure.If this climbing futures volume is followed by growth in the crypto’s open interest on trading platforms, it could provide fuel that helps fan the flames of Ethereum’s next uptrend.Featured image from Shutterstock.

Image Courtesy of SkewFutures volume tends to climb when traders believe that an asset’s movement is significant for its future prospects, with this ongoing rise suggesting that traders likely believe that this latest movement altered its underlying market structure.If this climbing futures volume is followed by growth in the crypto’s open interest on trading platforms, it could provide fuel that helps fan the flames of Ethereum’s next uptrend.Featured image from Shutterstock.