Aside from Bitcoin, the most talked-about cryptocurrency over the past few weeks has seemingly been Tether.The fourth-largest cryptocurrency by market capitalization, the stablecoin, which trades on markets as USDT, has become increasingly important to the crypto market. So much so that just the other day, data shared by Unfolded suggested that Tether’s market capitalization hit $7 billion, or approximately 3.4% of the entire industry’s value.It appears that growth is slowing, though. In fact, Whale Alert, a Twitter bot tracking large Bitcoin and other cryptocurrency transactions, recently revealed that $220 million worth of the cryptocurrency was burned by The Tether Treasury’s wallet.🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 220,000,000 #USDT (220,210,301 USD) burned at Tether TreasuryTx: https://t.co/gH5R6JSiZm— Whale Alert (@whale_alert) April 22, 2020

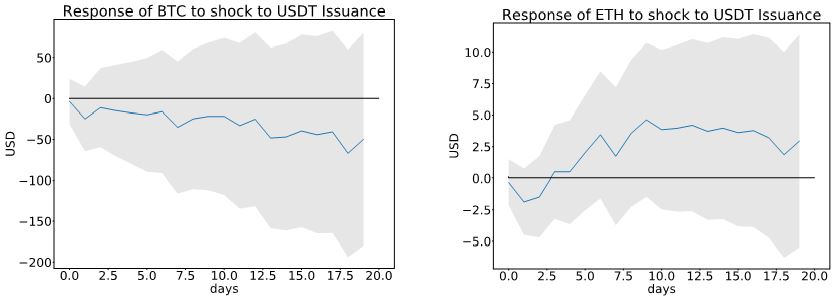

Paolo Ardoino, the CTO of Tether and Bitfinex, corroborated the burn, explaining in a tweet that the company had “reduced” the size of the USDT Treasury and adding that the coins burned were “authorized but not issued” to the market.Massive Burn Suggests Bitcoin May DumpAlthough Bitcoin hasn’t reacted to this move, flatlining ever since it hit $7,100 earlier today, Blockstream’s Zack Voell noted that every previous USDT burn (according to Whale Alert) has coincided “at or near pivotal points in the market.”Most often, his chart indicated, the pivotal points have preceded drops, like when USDT was burned around February 20th, near the top and just weeks prior to the drop to $3,700, or when it was burned in November last year, prior to the 35% drop to $7,000. Should historical precedent hold, that means there’s a good likelihood Bitcoin will reverse lower in the coming days and weeks.For some perspective, if Bitcoin does what it did last time there was a USDT burn, according to Voell’s chart, it will trade as low as $2,840 by the end of May or the start of June.Maybe There Is No RelationshipAlthough the chart above does seem to suggest that Bitcoin is soon to see some weakness, a report found that the issuance of USDT doesn’t have a positive impact on the price of BTC or other cryptocurrencies. By that same token, burns unlikely were the catalysts for the previous crashes marked in the chart above.In a note titled “Stable coins don’t inflate crypto markets” and published to economics research blog VOX, Richard K. Lyons and Ganesh Visawanath-Natraj — of UC Berkeley and Warwick Business School, respectively — explained that Tether and other stablecoins don’t naturally push Bitcoin higher.The core of their argument came down to the two charts seen below, which shows that from August 2017 to November 2019, there was no obvious trend to the prices of Bitcoin and Ethereum in the three weeks after USDT issuances.

Should historical precedent hold, that means there’s a good likelihood Bitcoin will reverse lower in the coming days and weeks.For some perspective, if Bitcoin does what it did last time there was a USDT burn, according to Voell’s chart, it will trade as low as $2,840 by the end of May or the start of June.Maybe There Is No RelationshipAlthough the chart above does seem to suggest that Bitcoin is soon to see some weakness, a report found that the issuance of USDT doesn’t have a positive impact on the price of BTC or other cryptocurrencies. By that same token, burns unlikely were the catalysts for the previous crashes marked in the chart above.In a note titled “Stable coins don’t inflate crypto markets” and published to economics research blog VOX, Richard K. Lyons and Ganesh Visawanath-Natraj — of UC Berkeley and Warwick Business School, respectively — explained that Tether and other stablecoins don’t naturally push Bitcoin higher.The core of their argument came down to the two charts seen below, which shows that from August 2017 to November 2019, there was no obvious trend to the prices of Bitcoin and Ethereum in the three weeks after USDT issuances. In fact, on average over the sampled time frame, Bitcoin trended lower immediately after Tether minted coins.Again, this may suggest that the seeming correlation between Bitcoin market tops (both local and macro tops) and USDT burns is just spurious.Photo by Denys Argyriou on Unsplash

In fact, on average over the sampled time frame, Bitcoin trended lower immediately after Tether minted coins.Again, this may suggest that the seeming correlation between Bitcoin market tops (both local and macro tops) and USDT burns is just spurious.Photo by Denys Argyriou on Unsplash