Key Takeaways

- Ethereum and Binance’s BNB both outpaced Bitcoin for returns in the past quarter.

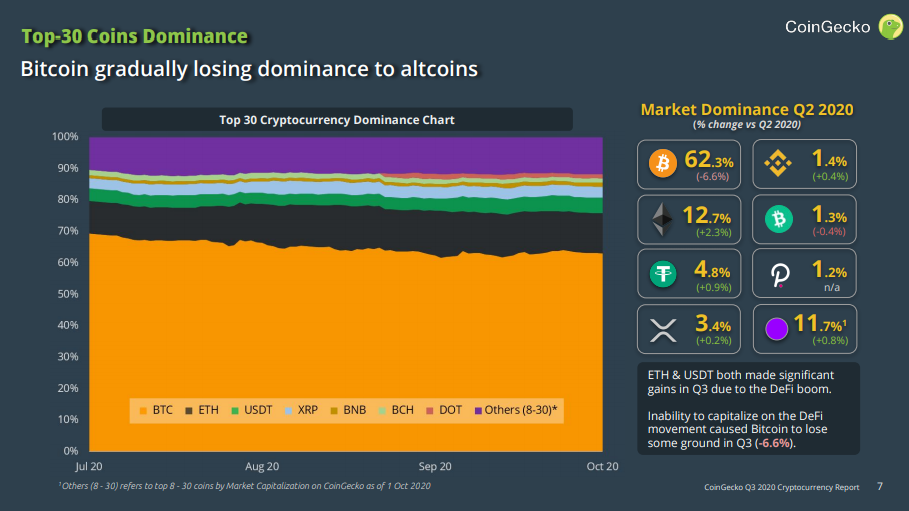

- BTC’s market dominance has faltered despite strategic investments from MicroStrategy and Square Inc.

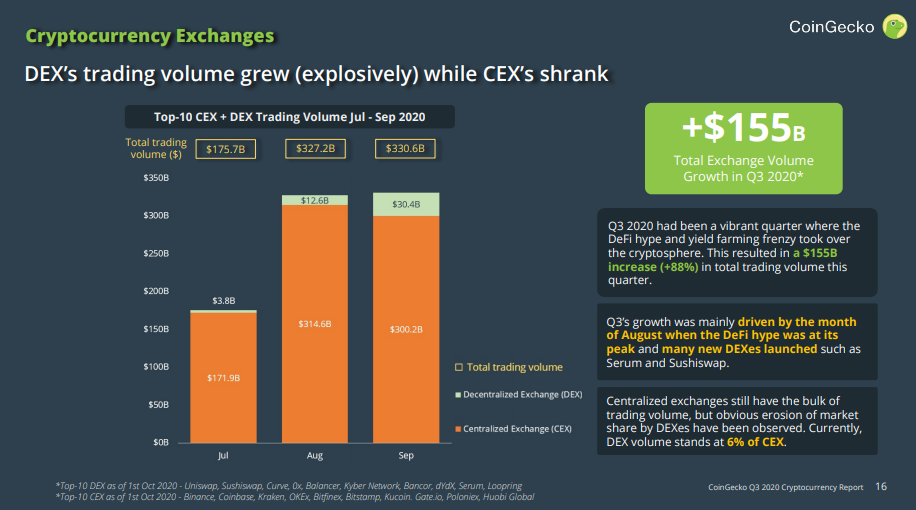

- The meteoric rise of the DeFi niche has been a bounty to decentralized exchanges, as some now compete with centralized platforms for volume.

Share this article

Dubbed “Summer of DeFi,” CoinGecko’s Q3 2020 report reveals many reasons for a celebration in crypto. It also offers enthusiasts a few surprises.

Spot market capitalization has risen by 31%, Bitcoin’s price spent most of its time above $10,000, and decentralized exchanges (DEXes) are stealing the limelight from their centralized counterparts.

Altcoins Outpace Bitcoin for Returns

Binance’s native token, BNB, was the most profitable crypto investment at more than 90% in positive returns. Ethereum followed behind, up 60%. Bitcoin still enjoyed double-digit growth at a modest 17%.

Though BTC lagged percentage-wise, the top crypto added much more to its market capitalization than both ETH and BNB combined.

Bitcoin’s rise represents approximately $40,228,217,099, while BNB’s gains represent only $1,385,669,007. Ethereum’s increase in price per coin earned it gains of $15,207,769,425.

However, to find the most significant returns on investment per coin, one need not look further than this year’s most popular niche: DeFi.

Starting with Compound in June, the hype attracted most of the attention for the rest of the summer. From scandals and drama to innovative products, DeFi is a story that keeps on giving.

And it gave the most to early adopters. UMA (UMA) gained 363% in value, followed by Aave (LEND) at 304% and Loopring (LRC) at 190%. Among the few Q3 losers, one can find the platform that started it all, Compound. Since the start of July, COMP has lost 38% of its value.

Bitcoin’s Dominance Falters Despite Major Investments

A micro-level investor that bought into most DeFi tokens, BNB, and ETH, gained more than BTC investors at the start of Q3 2020.

However, on a macro level, Bitcoin’s market capitalization gains outperform the rest of the market by a margin of magnitude greater than $25 billion.

According to the report, Bitcoin’s dominance is currently in a downtrend, which is interesting considering Microstrategy’s significant investments, followed by Square last week.

Bitcoin’s inability to capitalize on the DeFi hype caused capital to flow into both Ethereum and Tether. For now, there are no real conclusions to draw on the data, but if DeFi continues to grow and Bitcoin remains passive, we may end up seeing a Q4 where net gains of ETH and other cryptos is bigger than the net gain of BTC.

DEXes Continue to Eat Market Share in Q3

Investor’s and trader’s behavior is rapidly changing to include DEXes such as Uniswap. This is a cultural change that is unprecedented in an era of KYC and AML requirements coming to fruition.

DEXes and DeFi protocols caused significant strain on the Ethereum network. The community is also more open to Layer 2 solutions, and developers incentivized to innovate.

In September, 10% of trade volume happened DEXes, and with Layer 2 adoption around the corner, trade volumes on DEXs are likely to increase.

Crypto Closes Out Q3 2020

This past quarter was an extremely positive period for cryptocurrency. Even as most industries are struggling due to the rapid spread of COVID-19, the industry appears resilient to happenings in the rest of the world.

With American elections on the horizon, along with extreme volatility, this resilience may soon be put to the test.

Share this article

The DEX Top 10: Crypto Briefing’s Decentralized Exchange Picks

Every time an exchange is hacked, it seems a DEX springs up. Although these decentralized exchanges have advantages, it can be difficult to find the best one. Here are our…

Understanding Position Sizing

Let’s briefly examine the most important aspect of any trading system, position sizing, or specifically how much we will bet on any one given trading idea.

Binance Joins Yield Farming Craze, Launches Liquidity Mining Service

Binance, the top-performing crypto exchange, has announced a new savings service on the platform called “Launchpool.” This service will enable users to stake assets and earn token rewards leading up to…

Crypto Is Outperforming The Stock Market So Far This Year

Cryptocurrency has gained almost $50bn in total market capitalization since January 1st, making it one of the best performing asset-classes of 2019. Digital assets are growing faster than the world’s…