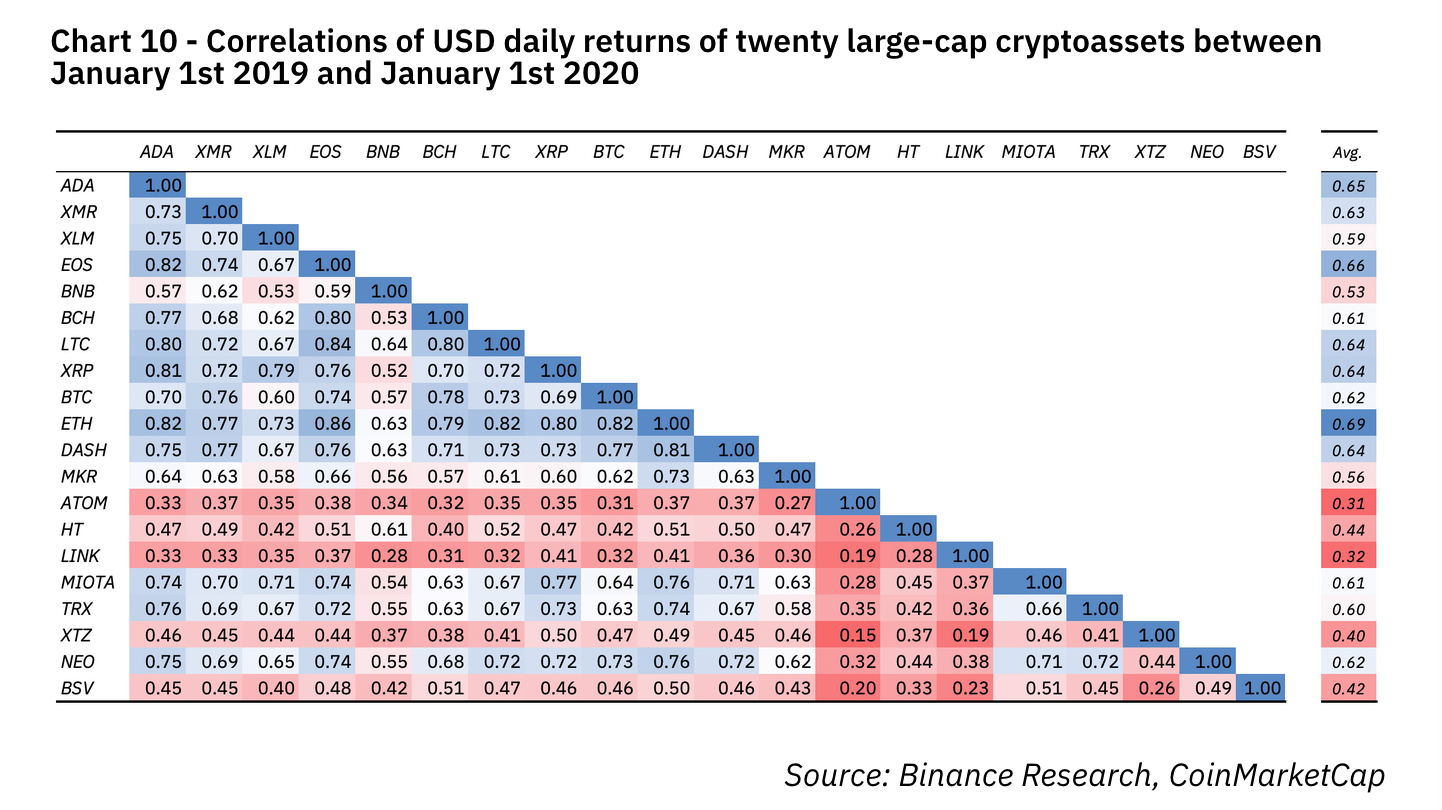

The cryptocurrency market embraced the new year by breaking out of dormancy to enjoy the market’s gains. Despite some corrections setting in, the positive outlook of the entire crypto-market remains unchanged. According to a report by Coin Metrics, there is a growing correlation between Bitcoin and other altcoins, a metric that gained strength in 2019. Binance Research highlighted the correlation analysis between large-cap crypto assets recently, with the results finding that they all appeared to be positive.

Source: Binance Research

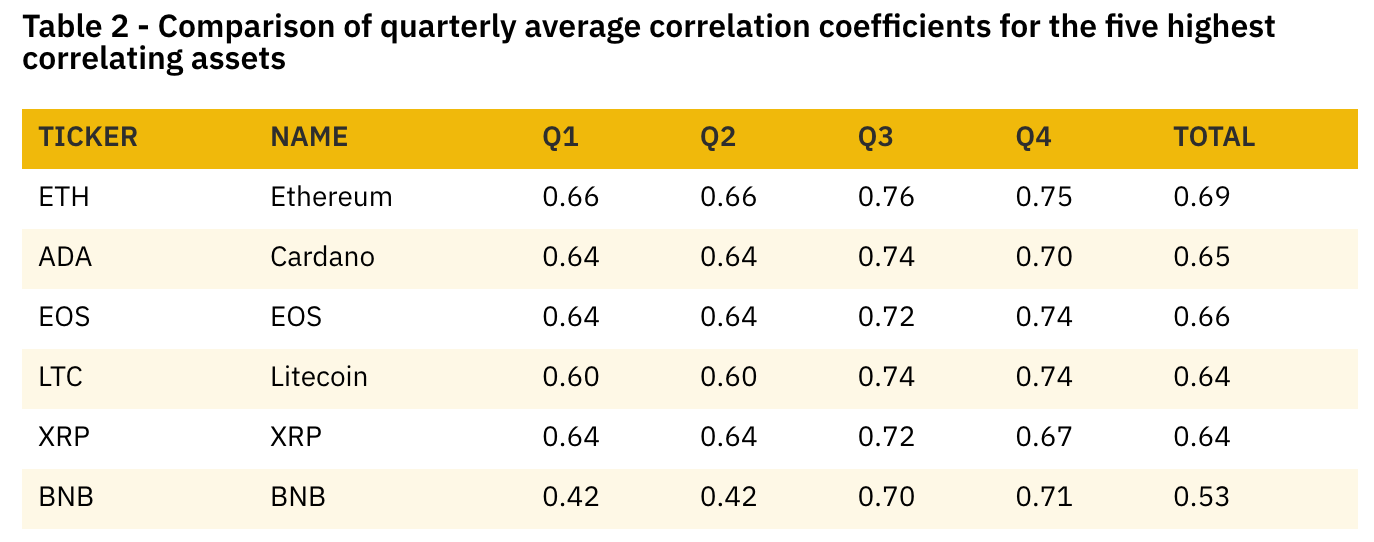

When the top 5 crypto-assets were analyzed based on their quarterly average correlation coefficients, the pairs reflected not only a positive outcome, but their coefficients were above 0.5 too. Ethereum was the highest correlated asset with a coefficient of 0.69, a figure that was much less correlated in the first half of 2019, but took the lead in the second half.

Source: Binance Research

The lowest correlated asset remained Cosmos [ATOM] with a correlation of 0.31, followed by Chainlink [LINK] and Tezos [XTZ] with coefficients of 0.32 and 0.4, respectively. The report noted their listing time as a differentiating factor between Cosmos and other large-cap assets. It got launched and was listed by the end of Q1 of 2019. It added,

“As the median correlation of ATOMs appears to be increasing – annual corr. coeff. of 0.31 for 2019 with a coefficient of 0.56 for Q4 2019 -, the lower listing time might be one factor to explain this phenomenon.”

Bitcoin’s correlation has been growing with Ethereum [ETH]. However, it shares a strong correlation with Bitcoin Cash [BCH] and Monero [XMR] as well. Another trend observed in the market was programmable blockchains like NEO, Ethereum, and EOS, which exhibited higher correlations with each other than with other non-programmable assets.